RoboStreet – August 14, 2025

Hot wholesale prices cool Fed cut hopes—why SPY may stay trapped in its range

For two weeks the tape has been a game of inches. SPY keeps running into a ceiling near 630–640 and finding buyers on pullbacks, with the near-term support band now clustered in the 600–620 zone (the prior 580–590 shelf still looms below). With leadership jammed into a handful of mega-caps, every new headline on rates, tariffs, or tech policy punches above its weight.

The tone cracked on August 1 after a soft July payrolls print—just 73,000 jobs added and 258,000 in downward revisions. Rate-cut odds for September jumped, and the market spent the next stretch treating every data release as a policy referendum.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

On August 7, Washington’s new tariff framework took effect, pushing the average effective U.S. tariff load into the high teens and layering 100% duties on select semiconductor imports. The consumer-price impact won’t appear overnight, but higher input costs tend to snake through supply chains over quarters, not weeks. Meanwhile, the U.S.–China tariff truce is nearing expiration. Officials are hinting at an extension, but until ink hits paper, globally integrated sectors—tech and consumer in particular—are trading with an extra dose of headline risk.

Tuesday’s CPI landed on the friendly side: headline inflation cooled to 2.7% year-over-year, just under expectations, while core held at 3.1%. Goods prices were contained; services were the fly in the ointment—medical care accelerated, transportation services surged, and airfares popped 4% after months of declines. Even the Fed’s “super-core” gauge ticked back to ~4% year-over-year, a reminder the last mile on inflation is rarely smooth.

Markets exhaled. Stocks pushed higher, the VIX slipped to 14.40 (lowest of the year), and yields eased. Traders even started entertaining whispers of a half-point September cut.

Thursday’s PPI ended that conversation. Wholesale prices jumped 0.9% month-over-month versus a 0.2% consensus—hot enough to vaporize those bigger-cut hopes. Odds of a 50 bps move dropped to zero; the probability of no cut at all crept back to 5.5%, leaving a 25 bps trim as the base case. The tape opened lower, then stabilized: the Dow off ~0.3%, the S&P 500 down ~0.2%, and the Nasdaq oscillating near flat.

The tell was breadth. Only 67 S&P names were green, yet the Roundhill “Magnificent Seven” ETF inched higher as Amazon and other mega-caps did the heavy lifting. Narrow leadership isn’t new—but the PPI shock made it glaring.

Weekly claims reinforced the “not too hot, not too cold” labor narrative—at least at the surface. Initial filings fell to 224,000 (better than the 229,000 expected), and continuing claims eased to 1.95 million from 1.97 million. This resilience gives the Fed cover to stay careful: if growth risks are rising but employment isn’t cracking, policymakers can keep rates higher for longer while watching the data glide path into Jackson Hole.

Under the macro noise, earnings continue to steer sector tone. AI remains the fulcrum: Nvidia and AMD will remit roughly 15% of AI-chip revenue from China to the U.S. government under export-license terms—a cost headwind, but not a demand killer given capacity constraints and secular build-out.

Cisco and Applied Materials reports will add color on orders, pricing, and where AI capex is actually landing (data center vs. edge). Looking ahead to next week, Home Depot and Lowe’s give us a read on home improvement elasticity under higher rates; Walmart and TJX speak to trade-down behavior and consumer health; Analog Devices is a clean window into industrial/auto/semi demand; and Zoom offers a barometer on enterprise spend.

Crude has bled lower—Brent around $65.91 and WTI near $62.92, roughly 10% below late-July levels—as U.S. output efficiency offsets price softness. The August 8 deadline for Russia to end the war in Ukraine passed without new sanctions, trimming near-term supply fears. The dollar weakened after CPI, then found a foothold post-PPI as the market re-priced the path of Fed easing.

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

After CPI, markets flirted with the idea of a 50 bps September cut. PPI slammed that door. The current setup implies a 25 bps trim as the base case with a small—but newly nonzero—chance of a “skip.” The deciding inputs from here: services disinflation (or not), the next read-throughs on producer prices and PCE, and any fresh tariff developments that bleed into goods inflation. The Fed minutes next Wednesday will be combed for tolerance around “higher for longer” versus the risk of overtightening into a softer labor backdrop.

In the short term, I’m market neutral. Expect a sideways grind with sharp, headline-driven edges. My working levels: SPY rallies into 640–650 should draw selling; pullbacks into 600–620 likely find dip buyers. Beneath that sits the prior 580–590 shelf, which matters on any deeper growth scare.

The longer-term trend remains under pressure. Recession odds have ticked higher, the policy path is clouded by sticky services inflation and tariff noise, and while the labor market is softening around the edges, it isn’t breaking—an awkward mix that argues for caution.

A few catalysts could force the range to resolve. A clean sequence of cooler producer-price and PCE prints would revive confidence in a glide-path to 2% and support a more durable bid. Conversely, another upside surprise in wholesale prices—or a tariff-driven bump in goods inflation—would keep the Fed cautious and sellers active into strength. An explicit extension of the U.S.–China tariff truce would ease one key tail risk for tech and global consumer names; a lapse would do the opposite.

This is the last meaningful run of inputs before the Fed’s pre-meeting quiet period and Jackson Hole. Housing starts and building permits arrive Tuesday, Fed minutes Wednesday, and flash PMIs Thursday. On the corporate side, watch Home Depot, Lowe’s, Walmart, TJX, Analog Devices, and Zoom for read-throughs on consumer stamina, inventory discipline, and capex priorities—exactly the levers that matter for the “higher for longer” debate.

In a market where breadth is thin and policy headlines move multiples, selectivity and discipline are non-negotiable. Lean into quality balance sheets, durable cash flows, and names with pricing power—especially in tech and industrials, where opportunity is real but volatility is a feature, not a bug. Treat 640–650 on SPY as an area to harvest strength and 600–620 as a zone to scale into defined-risk ideas. Keep time frames honest, position sizes modest, and stops mechanical.

Bottom line: Sideways—with bite. Until inflation convincingly cools on the producer side or policy risk fades, the market’s best trade is respecting the range and letting the data dictate when to press.

In this environment of mixed signals and quiet volatility, disciplined trading and data-driven strategy are essential. At Tradespoon, our predictive models are built to adapt in real-time—highlighting breakout candidates, identifying hidden rotation trends, and forecasting high-probability moves with precision.

If you’re feeling overwhelmed by headlines and contradictions, you’re not alone. Let our tools help cut through the noise and keep you focused on what matters most.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

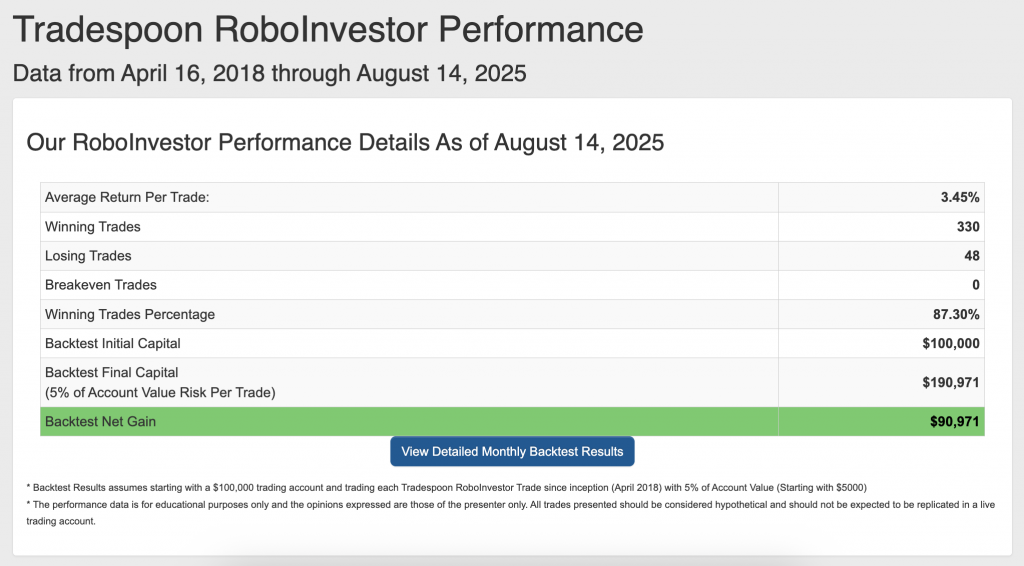

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.30% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!