On Thursday, stock markets witnessed a seesaw of market emotions as the day concluded on a cautiously optimistic note. Breaking a two-day losing streak, the three major indices managed to muster a modest gain in the final hours of the session. The stock market eked out a slight elevation following the release of a consumer price index (CPI) reading that turned out to be cooler than anticipated. While stocks climbed initially, the surge was tempered by the realization that consumer prices had surged at a 3.2% annual pace in July, surpassing June’s 3% rate. However, the core inflation rate, which excludes volatile food and energy components, exhibited a minor deceleration from 4.8% to 4.7%.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

July Inflation Figures: A Delicate Balance

The standout report of the day was the disclosure that consumer prices had advanced at a 3.2% annual pace in July, marking a lift from June’s 3% growth, primarily driven by robust service costs. Nevertheless, the core prices, which strip away the unpredictable food and energy segments, showed a deceleration to a 4.7% annual pace, down from June’s 4.8%.

The July inflation figures danced on a tightrope – while headline inflation ticked up to 3.2% annually, exceeding June’s 3%, it fell short of the economists’ predictions. Consequently, the odds of the Federal Reserve maintaining the current interest rates surged to 90.5% from 82% a week prior, according to the CME FedWatch Tool. The likelihood of no rate hike after the September and November meetings also increased to 70.9% from 68.4% a week ago. Despite these shifts, their impact on the market’s upward trajectory remained limited.

Behind the Numbers: A Deeper Dive into the CPI

July’s inflation surge was primarily fueled by an upswing in shelter costs, contributing over 90% to the overall monthly increase. Grocery prices gained momentum, rising 0.3% in July after a flat June. However, the gains in other sectors were relatively modest: Core goods costs dipped due to falling prices in the automobile market. Medical and energy services, as well as apparel costs, remained relatively steady, showing no significant fluctuations.

Fed’s Focus on Core Inflation: The Path Forward

The Federal Reserve’s focal point remains on core inflation, which has shown a consistent downtrend since September of the previous year, aligning it with levels observed in the autumn of 2021. Even a gentle continuation of this cooling trend would indicate that the central bank’s measures to rein in inflation are effective, strengthening the belief that interest rates will remain steady in the upcoming September 19-20 meeting.

Disney’s Twist and China’s Recovery

In the lead-up to Thursday’s critical inflation report, Wednesday witnessed a downtick in stock values. Amidst this backdrop, Disney’s mixed financial results generated waves. The entertainment giant’s announcement of increased prices for its streaming services, coupled with a crackdown on password sharing, initially caused a 2% dip in the stock. Yet, it rebounded during the earnings call and surged by about 2% on Thursday morning. However, Disney stock’s performance has been relatively stagnant since the beginning of the year.

In a global context, China stocks regained lost ground to conclude higher, overcoming earlier setbacks following the announcement of a U.S. executive order curbing investment in Chinese high-tech sectors. The order particularly targeted semiconductors and artificial intelligence, prompting increased disclosure requirements for American companies investing in various Chinese firms.

Navigating Market Dynamics: Upcoming Earnings and Inflation

The week kicked off on a positive note, with Wall Street bouncing back from last week’s losses. The market’s attention shifted to the impending U.S. inflation data, a significant influencer on the Federal Reserve’s rate decisions. As stocks rebounded and market volatility subsided, a more composed trading atmosphere emerged.

While the majority of stocks rode the rally’s wave, Apple continued to experience downward momentum, further weakening by 1.9%. This slump positioned the tech giant as the Dow Jones Industrial Average’s underperformer.

The ongoing earnings season showcased a mix of impressive performances and notable letdowns, notably exemplified by Apple’s struggles. The upcoming earnings releases, including industry giants like Walt Disney and UPS, are poised to shape the market’s trajectory. Thursday’s consumer price index (CPI) data release remains a focal point, with analysts predicting a 3.3% year-on-year CPI rise and a 4.8% increase in the core CPI, excluding volatile components.

As the market transitioned from July’s robust rally to a potentially challenging August, marked by historical stock market difficulties, cautious market participants curtailed their activity. This shift could introduce heightened volatility in the latter half of the year.

Earnings Lineup and the Inflation Horizon

The upcoming week’s earnings calendar features prominent names, including BioNTech, Barrick Gold, Eli Lilly, Take-Two Interactive Software, UPS, Walt Disney, Trade Desk, Wynn Resorts, Alibaba Group Holding, Brookfield, News Corp, and Ralph Lauren. These reports, along with the eagerly anticipated July consumer price index data by the Bureau of Labor Statistics, promise to steer the market’s course. Consensus estimates indicate a slight uptick in inflation, with the core CPI rising incrementally compared to June’s figures.

Navigating Uncertainties: A Balanced Approach

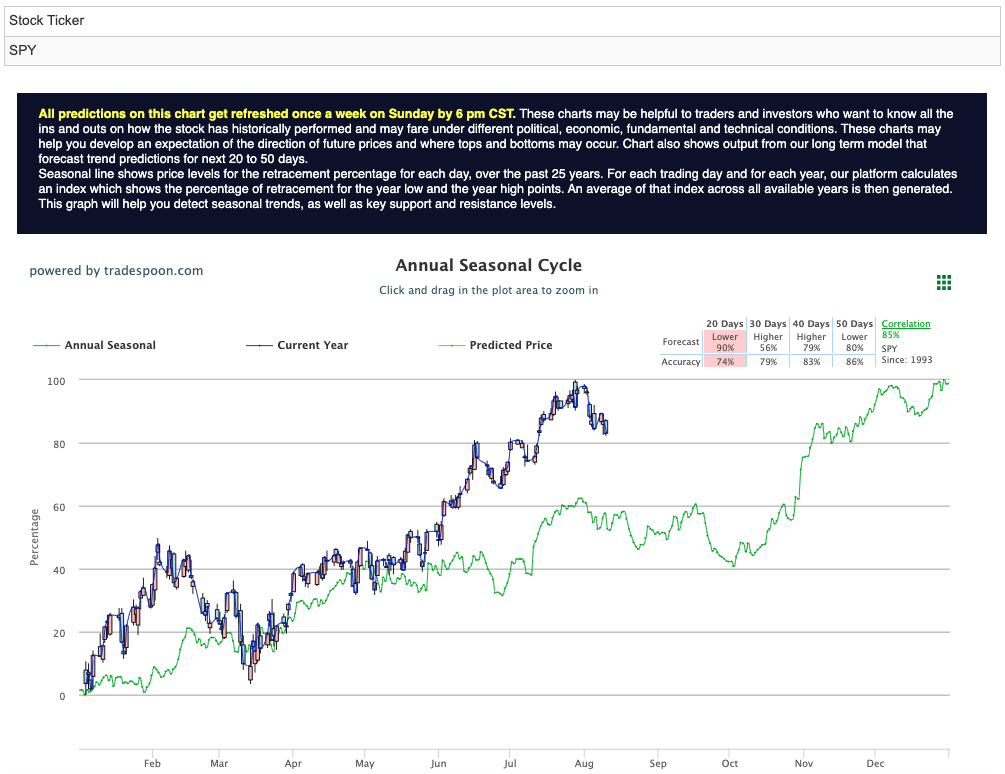

In an economic climate characterized by low recession probabilities and a declining $DXY, market observers are cautiously neutral about the road ahead. After a mid-summer shift in sentiment, expectations of elevated volatility persist for the latter part of the year. Despite the optimistic outlook, experts predict a potential SPY rally ceiling within the $450-470 range, identifying short-term support levels at 400-430 over the forthcoming months. For reference, the SPY Seasonal Chart is shown below:

Amid the rollercoaster ride of market uncertainties, consumer staples have stood out as a stable haven for investors. These essential products and services, including food, beverages, household items, and personal care products, remain in demand regardless of economic fluctuations. Companies in the consumer staples sector often provide consistent dividends and stable growth, making them an attractive choice for risk-averse investors seeking stability in their portfolios.

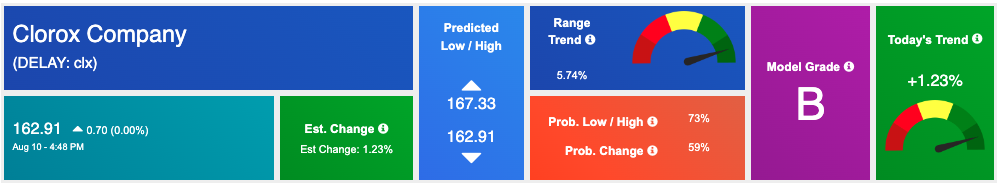

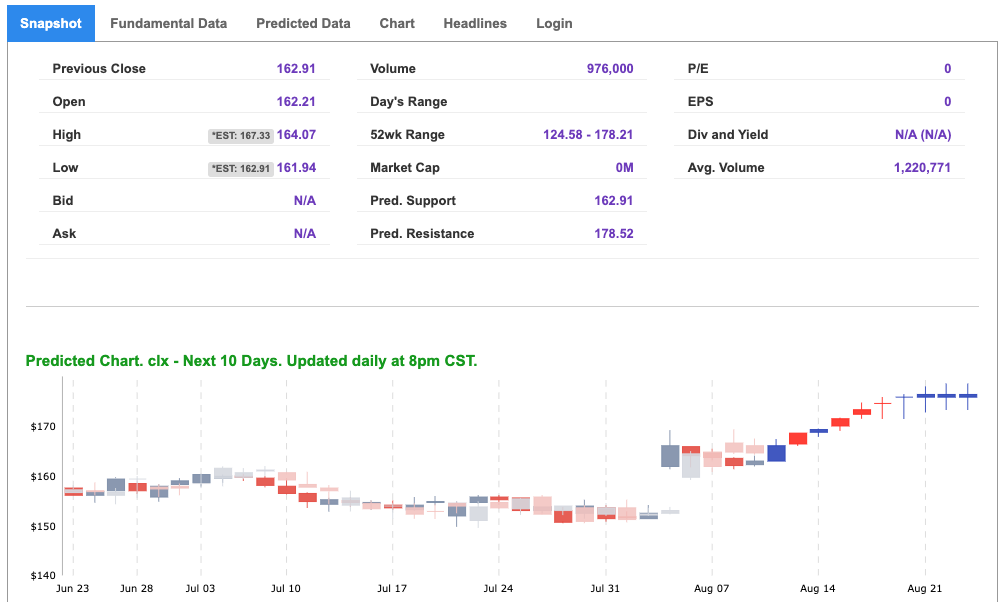

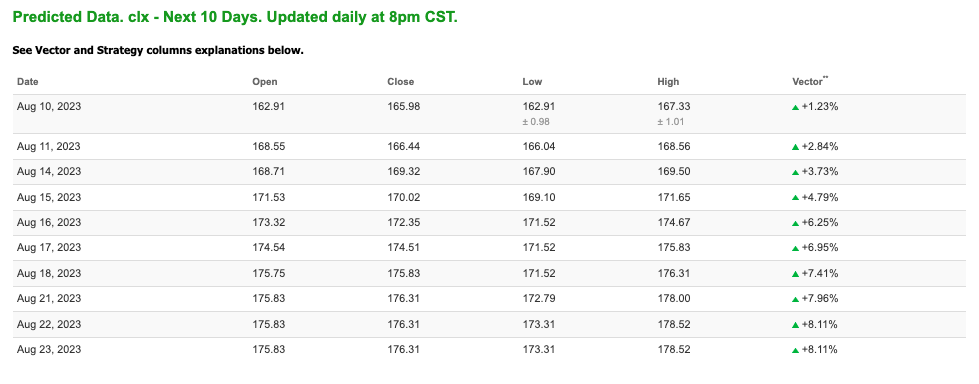

Clorox Company ($CLX) has established itself as a leading consumer staples company with a focus on household and professional cleaning, as well as personal care products. Clorox’s extensive portfolio includes well-known brands like Clorox bleach, Pine-Sol cleaners, Burt’s Bees personal care, and Glad bags. With a reputation for quality and reliability, Clorox has captured a substantial share of the consumer goods market.

In the wake of recent market developments, including the recent downgrade and the heightened volatility triggered by CPI data, investors are seeking stability. Clorox ($CLX) emerges as a strong candidate for investment due to its position within the consumer staples sector, which traditionally performs well in uncertain times.

The company’s diversified portfolio of essential products ensures consistent demand, even during economic downturns. As consumers continue to prioritize cleanliness and hygiene, Clorox’s cleaning and personal care products maintain their relevance. Additionally, Clorox’s established brand reputation and strong market presence contribute to its resilience.

Considering the market-neutral approach you’re adopting and the economic data suggesting a low likelihood of recession, Clorox’s stability aligns well with your strategy. As the $DXY pulls back significantly, this can further enhance the attractiveness of consumer staples like Clorox. The company’s consistent dividend payouts can provide a reliable income stream, appealing to investors seeking steady returns.

The recent downgrade has injected uncertainty into the financial sector, resulting in a spike in the volatility index (VIX). Simultaneously, the Dollar Index ($DXY) has been rallying, and longer-dated treasuries have seen a sharp rise in yields, challenging October highs.

In this dynamic environment, your shift to a market-neutral stance is a prudent strategy. The cautious optimism stemming from favorable economic data, combined with the $DXY’s retreat, sets the stage for a balanced approach. Consumer staples, epitomized by Clorox ($CLX), provide a safe harbor in volatile seas, offering stability and potential gains regardless of market turbulence.

As you continue your journey in the investment landscape, the blend of Clorox’s consistent performance, coupled with the data-driven insights, positions you well to navigate the complexities of market trends and capitalize on opportunities while minimizing risk.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

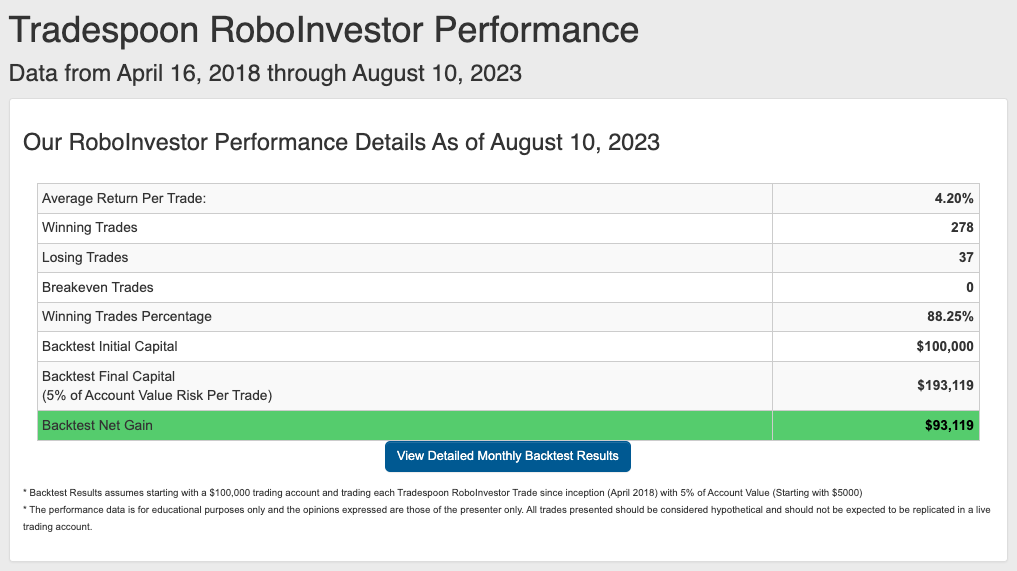

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we continue onto the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!