From Friday’s soft-landing setup to Monday’s follow-through—and how we’re positioning into Jobs Week

Markets ended last week with a familiar tailwind—rate-cut momentum plus AI enthusiasm—and kicked off this week with something the rally has needed: broader participation. The Fed’s September 17th 25 bp cut, framed as risk management rather than a rush back to zero, shifted the debate from if to how quickly further easing arrives. That policy backdrop, combined with another wave of AI headlines, helped push indexes back toward record territory even as valuations drew scrutiny.

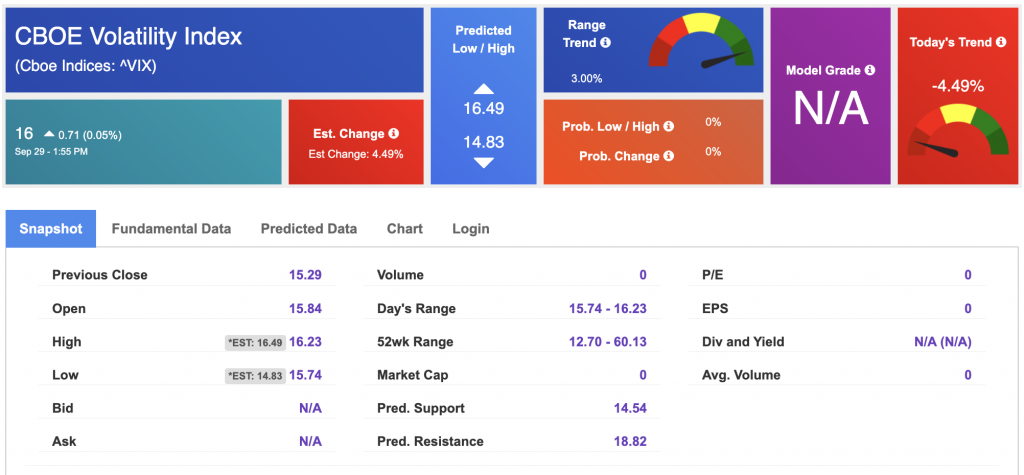

Volatility stayed calm with VIX near 16. The 10-year yield chopped inside its well-worn 3.6%–4.8% range, easing on labor revisions that pointed to a cooler jobs backdrop. Inflation was firm month-over-month but broadly steady year-over-year, core cooled at the margin, and producer prices eased—enough to keep “sticky inflation” worries in check. Under the surface, leadership was still narrow: tech and communication services did most of the lifting while energy lagged despite only modest moves in crude. Earlier in the week, the Morningstar U.S. Market Index was up about 1.25% before a mild wobble. Geopolitical tensions flared and then faded as de-escalation headlines followed Israel’s strikes against Iran.

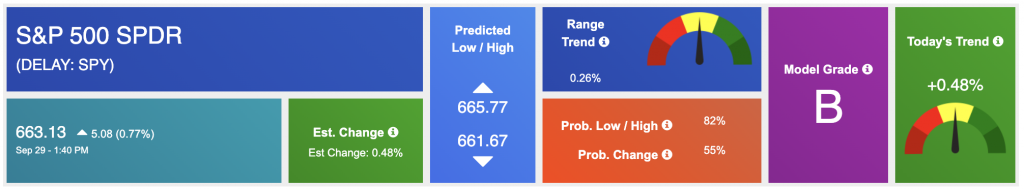

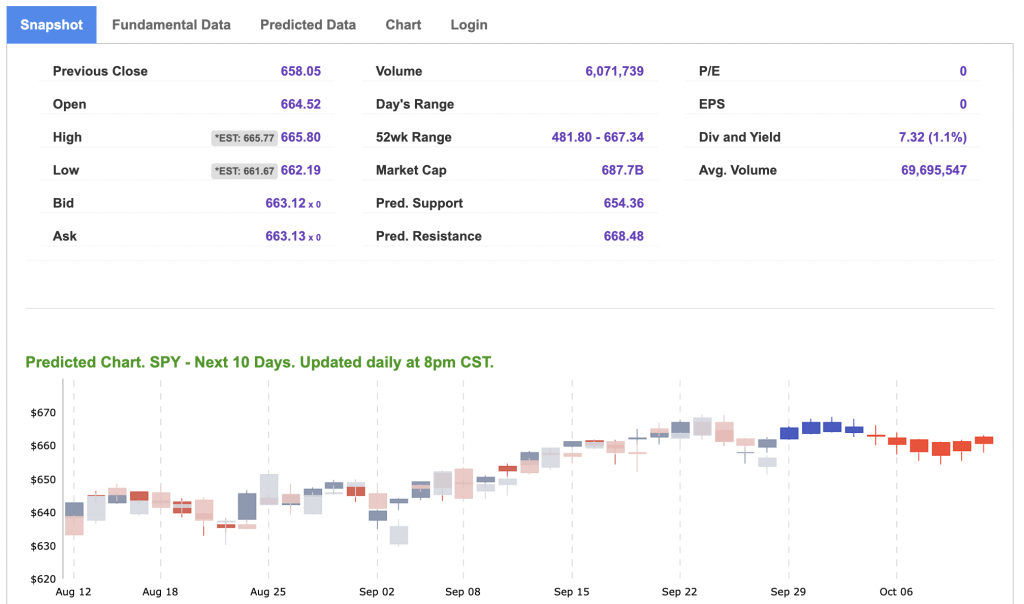

SPY roadmap: if momentum holds and breadth doesn’t worsen, the rally can extend toward 680–700, with 620–640 as working support over the next few months. The main risk is a “higher-for-longer” rates scare colliding with a softening labor market.

The new week opened with a modest risk-on tone and, importantly, wider breadth. The Dow flipped positive late to finish up around 0.1% with a majority of components higher. The S&P 500 gained roughly 0.3% with more than 300 advancers, and the Nasdaq added about 0.6%. Tech still led, but gains spread to materials, consumer discretionary, financials, health care, industrials, real estate, and utilities. Energy was the clear laggard, down ~2.1%.

Corporate headlines added texture. Electronic Arts agreed to be taken private in an all-cash deal valuing the company near $55B, highlighting the premium for durable cash-flow franchises. Occidental Petroleum firmed on reports it may sell its OxyChem unit for roughly $10B. In semis, Nvidia started the week higher while Intel cooled after last week’s outsized 20% jump—more rotation than reversal.

Macro and policy stayed front-of-mind. Treasury yields and the dollar edged lower as investors weighed a possible government shutdown and whether it could delay Friday’s BLS payrolls report. The ADP snapshot lands Wednesday; economists expect around 45,000 jobs and unemployment near 4.3%—a “good-enough” mix to preserve the soft-landing narrative even as inflation remains a watchpoint. After Monday’s bell: Jefferies, Progress Software, Vail. Later in the week: Nike, Paychex, Lamb Weston, United Natural Foods, RPM, Acuity, Conagra, and Cal-Maine—guidance will shape whether participation broadens beyond mega-cap tech.

Friday’s policy-plus-productivity setup—insurance-style cuts and AI-driven operating leverage—carried into Monday with healthier internals. Breadth widened, rates eased, and the dollar softened on fiscal noise. It’s the same bull case, now on sturdier footing—so long as energy weakness and funding drama don’t tighten financial conditions.

This is a jobs-anchored week. A steady labor profile keeps the runway clear for additional cuts and supports multiples. A hot surprise in the inflation components—or a sharper leg down in employment—would force a quick reset in rates and valuations. ISM/PMIs and confidence readings add color on growth momentum. Tariff chatter and government-funding negotiations stay in the background but can still jolt yields and the dollar.

With momentum back in gear, I prefer buying controlled dips into the mid-630s on SPY with risk clearly defined below 620, rather than adding net delta near the 690 handle. Tradespoon’s AI outlook is modestly bullish for the next ten sessions, with better-than-even odds of probing the 680s if earnings tone holds and rates stay calm. The highest near-term drawdown risk sits in the 635–645 band; a daily close below 620 would put the trend in repair mode. Practically, this argues for keeping core exposure to leaders, using defined-risk spreads on relative-strength names, and rolling winners instead of chasing breakouts.

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

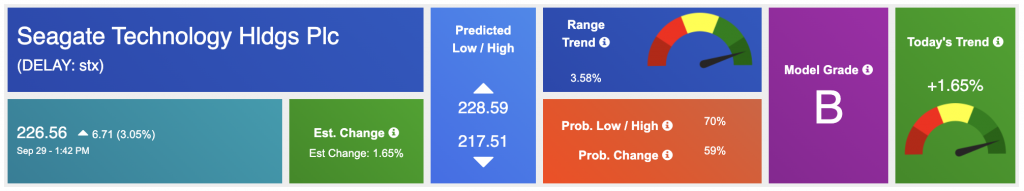

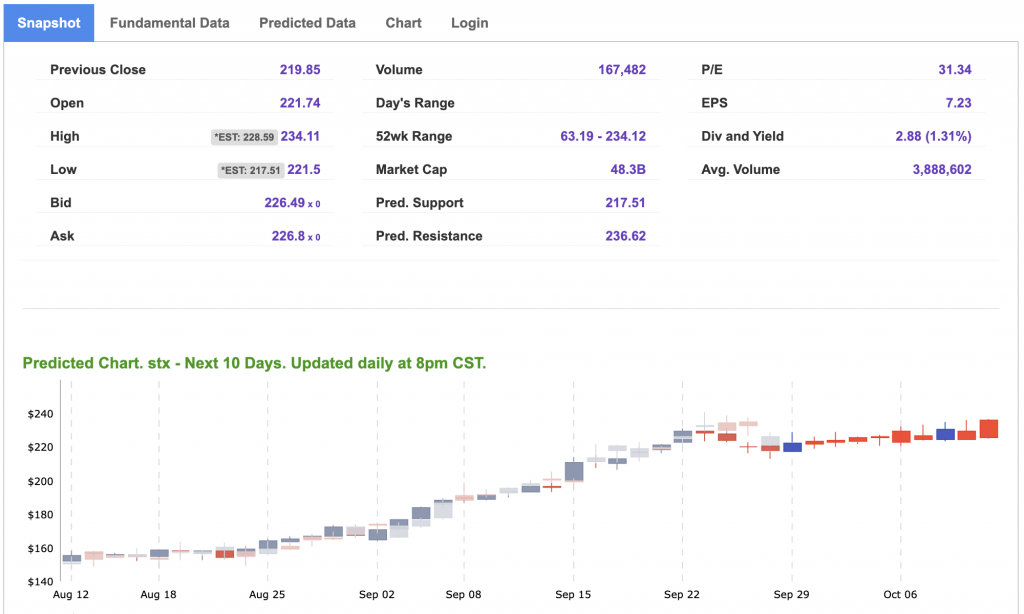

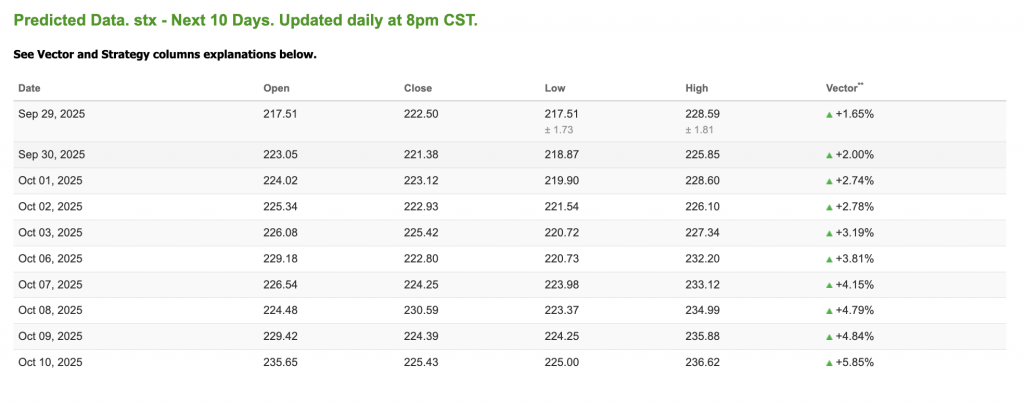

Our featured symbol for Tuesday is STX. SeaGate Technologies Holdings is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $226.56 with a vector of +1.65% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, stx. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

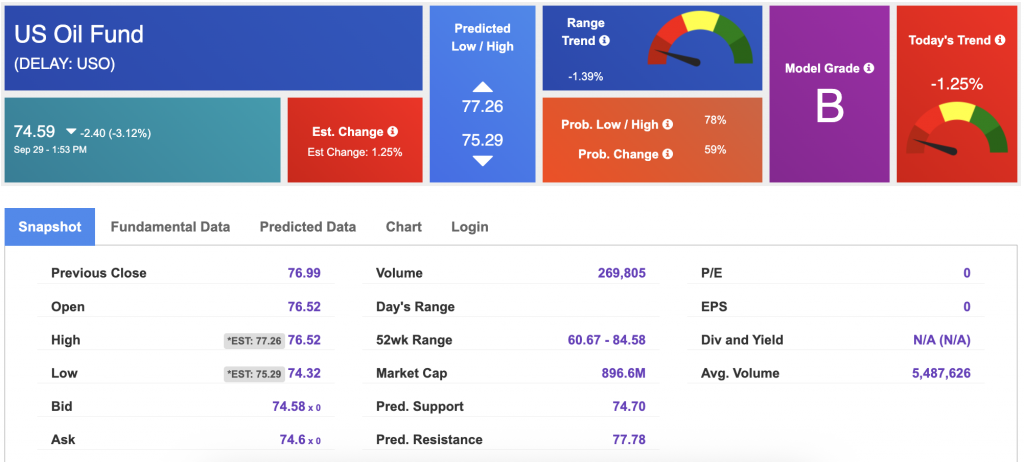

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $63.20 per barrel, down 3.83%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $74.59 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

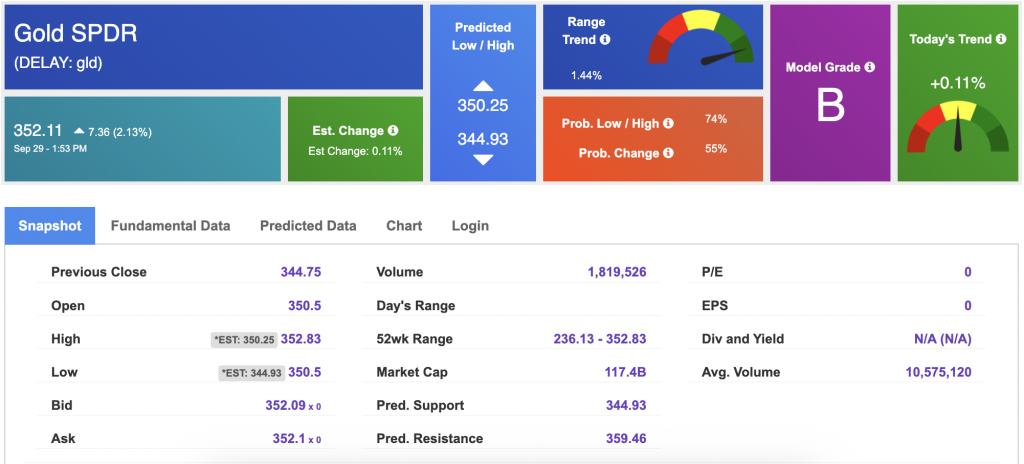

The price for the Gold Continuous Contract (GC00) is up 1.17% at $3,852.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $352.11 at the time of publication. Vector signals show +0.11% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

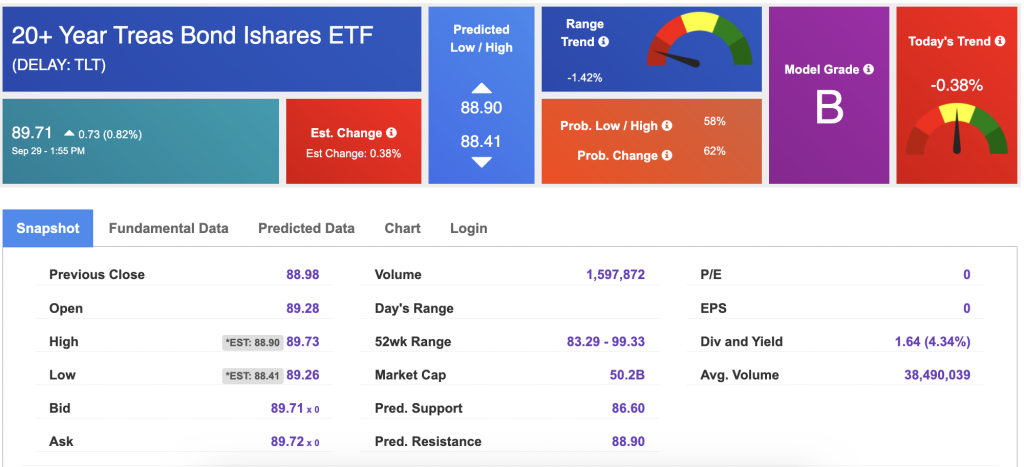

The yield on the 10-year Treasury note is down at 4.145% at the time of publication.

The yield on the 30-year Treasury note is down at 4.760% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $16 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!