RoboStreet – Weekly Market News & Sentiment: TSMC Ignites AI Rally, Oil Slides, and Rates Keep Markets on a Tight Leash

Thursday delivered a clean “reset” session: the market snapped a two-day skid, the Dow gained roughly 290 points, and the S&P 500 and Nasdaq pushed modestly higher as investors leaned back into risk—selectively. Smaller caps stole the spotlight again, with the Russell 2000 leading the major indexes and continuing to reflect a notable early-year rotation into domestically geared names and laggard segments that finally have room to run.

Under the hood, the bond market stayed in charge. The front end firmed with the 2-year yield pressing into the mid-3.5% area, while the 10-year hovered in the low-4% range—still volatile enough to tighten financial conditions quickly if the next catalyst tilts inflation expectations higher. In a market trading near all-time highs with the VIX sitting around the high-teens, that rate backdrop is the difference between a smooth grind higher and a choppy tape that demands patience.

Globally, the tone improved as energy backed off. Oil’s pullback eased pressure on inflation-sensitive assets and helped the market treat geopolitical risk as “manageable” rather than “disruptive” for now—an important distinction when valuations are already pricing in a fairly optimistic 2026.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The day’s leadership was clear: semiconductors and AI-linked infrastructure took the baton. Taiwan Semiconductor’s results and outlook did more than beat expectations—they reinforced the market’s core narrative that the AI buildout is not a one-quarter trade, but a multi-year capital cycle. TSMC’s plan to spend aggressively to meet demand (with capital expenditures guided well above what many expected) sparked broad follow-through across the chip complex and especially across the “picks-and-shovels” names that benefit when fabs expand, and utilization stays elevated. That’s why the biggest percentage winners clustered around equipment suppliers and process-control leaders.

At the same time, the market’s internal rotation remained visible. A recent soft patch in software lingered as capital flowed toward “hard AI” exposure—compute, semis, infrastructure—rather than higher-multiple application stories. It wasn’t a risk-off signal so much as a preference shift: when investors feel like they’re paying up, they want the most direct line to demand.

Energy told the opposite story. As crude slid sharply toward the $60 area on signs that U.S.–Iran tensions could cool, the sector lost its bid, and the inflation impulse faded for the session. That drop mattered beyond oil stocks: it helped stabilize the broader market by taking some heat out of the inflation narrative and giving equities room to breathe.

Zooming out to the week, earnings provided the backbone. Major reports from JPMorgan, Morgan Stanley, and Delta anchored sentiment and reinforced a familiar theme: markets can tolerate a lot of noise when corporate results and guidance remain resilient. Macro data releases added texture, but earnings and rates remained the true drivers.

The week’s most consequential headline risk wasn’t economic—it was institutional. Renewed pressure around Federal Reserve independence introduced a different kind of uncertainty: not “will growth slow?” but “will the policy framework remain credible?” Even when markets appear to shrug it off intraday, that type of risk tends to show up indirectly—via the dollar, the term premium, and the market’s willingness to pay peak multiples.

The dominant mood is cautiously optimistic—buyers are still present, but they’re pickier, quicker to rotate, and far more sensitive to rates than they were during earlier phases of this cycle. That’s why the market’s swings can look outsized even when the headlines feel incremental. When inflation expectations tug one way and growth expectations tug the other, you get a tape that alternates between “buy the dip” and “reduce exposure” without much warning.

What’s encouraging is the breadth. Small caps showing sustained leadership—alongside strength in industrial and materials pockets—suggest this rally isn’t purely a mega-cap story. But the caution signs are real: software weakness, financials under pressure on policy headlines, and a bond market that refuses to settle into a tight range all point to a market that can advance, but probably won’t do it in a straight line.

I remain market-neutral here. Momentum has softened, and the biggest risk to equity stability is still the same: rates staying higher for longer while unemployment indicators continue to tick up. When the 10-year trades in a wide band and the front end keeps testing higher levels, equities don’t get a free pass—each new high has to be “earned” by real earnings strength and stable inflation expectations.

From a roadmap perspective, I still see a path for the SPY to press toward the 700–720 zone if earnings hold up and yields stay contained. But in the near term, 650–660 remains key support—the kind of level that matters not just technically, but psychologically. If we hold that area on pullbacks, it keeps the “buyable dip” regime intact. If we lose it on rising yields, the market’s character changes fast. For reference, please see SPY Seasonal Chart:

My playbook for next week is simple: stay selective, lean into areas where demand is structural (AI infrastructure is the obvious example), and resist the urge to chase rebounds in the weakest pockets just because the indexes are near highs. I’m also watching the bond market closely—if long-end yields re-accelerate, the market will reprice risk quickly, no matter how strong the earnings headlines look.

That’s exactly where RoboInvestor proves its value. Built for a rangebound, headline-sensitive tape, our flagship AI-driven advisory helps you cut through shutdown noise, tariff chatter, and AI hype to focus on what matters: statistically grounded setups and the clearest risk-reward opportunities. With RoboInvestor, you can stay invested, stay disciplined, and act with precision instead of reacting to every headline.

Every other weekend, you’ll receive the RoboInvestor newsletter—a concise, high-signal read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas so you’re prepared and confident heading into Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

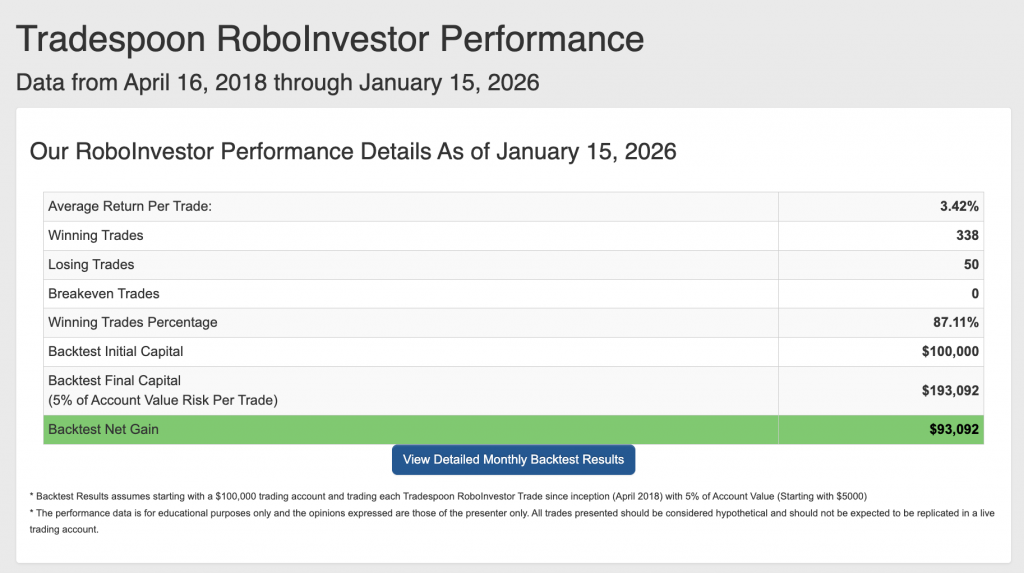

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 87.01% since April 2018.

As we kick off 2026, investors are stepping into a market that still feels deceptively calm on the surface—but increasingly reactive underneath. Tariff headlines are back in rotation, the Fed path is less predictable as inflation expectations tug both ways, and the economy is sending mixed signals as rates stay elevated and labor-market indicators begin to soften at the margins. Volatility remains contained, yet quick to spike around policy shifts and geopolitical developments, while earnings and forward guidance continue to do the heavy lifting for direction.

In this environment, a disciplined, insight-driven framework matters more than ever—one that cuts through the noise, respects the bond market’s influence, manages rate and employment risk, and helps you position proactively for the opportunities and pivots that tend to define the first quarter.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!