In a week marked by significant market activity and economic data, tech stocks surged following Nvidia’s impressive earnings report, overshadowing concerns about rising interest rates and economic indicators.

After a surprisingly high Consumer Price Index (CPI) and Producer Price Index (PPI), interest rates have been trading at the upper end, with the 10-year Treasury yield reaching 4.3%. Additionally, the Dollar Index ($DXY) faces resistance in the $105-107 range. Despite negative leading indicators, there are signs of a potential soft landing, easing fears of a recession.

A notable phenomenon in the market has been the gamma squeeze experienced by NVDA, ARM, and SMCI stocks, accompanied by consolidation in AAI (artificial intelligence and automation) stocks. This trend typically suggests short-term market consolidation and vulnerability to pullbacks, with bullish sentiment reaching extremes.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Amidst this backdrop, Nvidia released its earnings report, exceeding analysts’ expectations with revenue of $22.1 billion for the latest quarter, surpassing the anticipated $20.4 billion. Moreover, the company’s outlook for the current quarter was strong, further boosting investor confidence. Nvidia shares initially rose by 6% in after-hours trading, reflecting the positive reception to its performance.

As a bellwether for artificial intelligence demand, Nvidia’s performance has a ripple effect across the broader tech sector and the market as a whole. Despite a brief dip after the release of Federal Reserve meeting minutes, which investors scrutinized for potential impacts on Nvidia’s earnings, the stock ultimately rallied, with shares jumping 7.7% in late trading.

The momentum continued into Thursday, driving a tech rally fueled by optimism over artificial intelligence. Even indications of a slower pace of interest rate cuts from the Federal Reserve failed to dampen market enthusiasm. Notably, Nvidia’s stock surged by 16% on Thursday, contributing to record closes for the S&P 500 and the Dow Jones Industrial Average, and near-record levels for the Nasdaq Composite.

Philip Jefferson, vice chair of the Federal Reserve’s Board of Governors, expressed confidence in a soft landing for the U.S. economy, suggesting that the next move in interest rates could be downward. This sentiment was echoed by positive developments in the manufacturing and services sectors, as reflected in the S&P Global Flash U.S. Composite PMI.

Meanwhile, the real estate market showed signs of recovery, with home sales picking up in January after a period of stagnation attributed to higher mortgage rates. Despite lingering concerns about the impact of rising rates, the National Association of Realtors reported a notable increase in the pace of home sales.

Looking ahead, some market participants are adopting a market-neutral stance, anticipating patterns of higher highs and higher lows in the coming weeks. However, there are reservations about the sustainability of the recent rally, with expectations that the SPDR S&P 500 ETF (SPY) may encounter resistance around the $500-510 levels, while short-term support is seen in the 460-470 range. To provide a visual reference, the SPY Seasonal Chart is presented below:

While the market remains buoyant in the short term, investors are advised to exercise caution amidst ongoing volatility and evolving economic conditions. The performance of key players like Nvidia will continue to shape market sentiment and drive investor confidence in the tech sector’s growth prospects. With this in mind, one company has caught my attention.

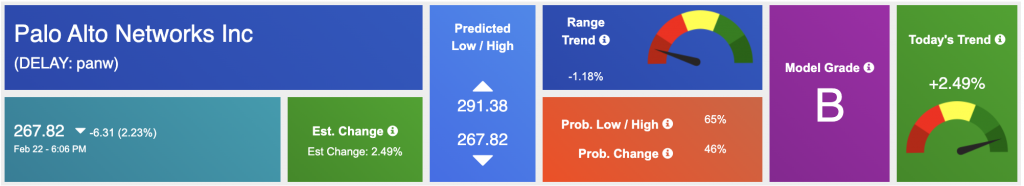

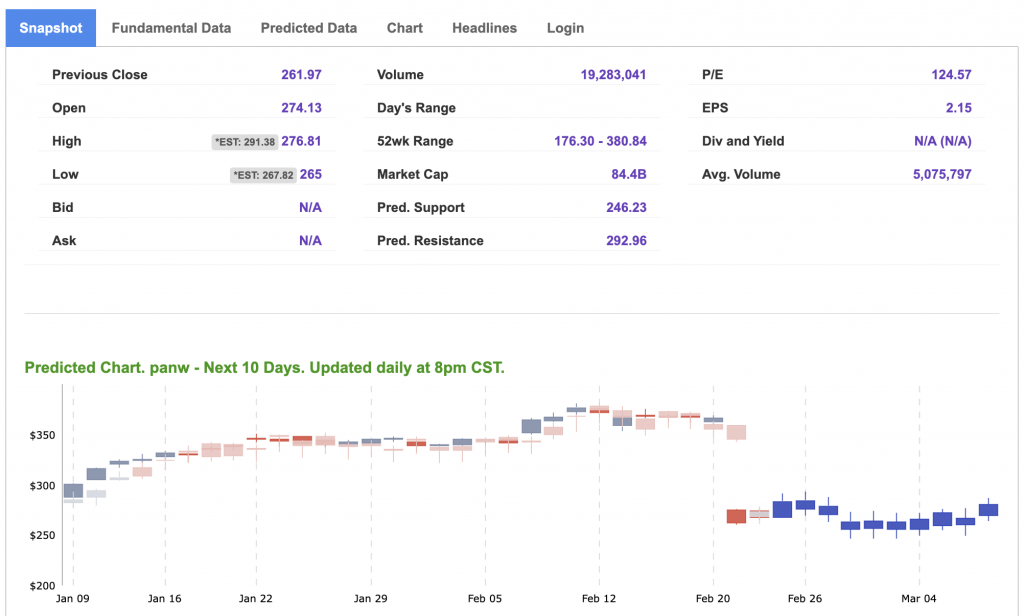

Palo Alto Networks (PANW) leads the charge in cybersecurity, offering cutting-edge solutions to shield organizations from evolving cyber threats. Founded in 2005 by Nir Zuk, a former engineer at Check Point and Juniper Networks, Palo Alto Networks has cemented its position as a frontrunner in firewall and cybersecurity technology. Its advanced security platform integrates next-generation firewalls, cloud security, and AI-driven threat detection to provide comprehensive protection for enterprises globally.

In today’s tumultuous market landscape marked by geopolitical tensions and rising cyber risks, Palo Alto Networks emerges as an attractive investment opportunity for several reasons. Palo Alto Networks has consistently demonstrated financial resilience and stability, instilling confidence among investors. With a proven track record of delivering robust earnings and revenue growth, the company has solidified its standing as a dependable player in the cybersecurity sector. Despite market fluctuations, Palo Alto Networks has remained steadfast, expanding its market share and fortifying its competitive position.

Palo Alto Networks has a history of strategic acquisitions and collaborations aimed at enhancing its product offerings and market presence. By investing in innovative technologies and forging partnerships with industry leaders, the company remains agile and responsive to evolving cybersecurity challenges. Recent acquisitions, such as the integration of Expanse to bolster its attack surface management capabilities, underscore Palo Alto Networks’ commitment to innovation and expansion.

With the accelerating adoption of cloud computing and remote work arrangements, the demand for cloud security solutions is on the upswing. Palo Alto Networks’ cloud security platform, Prisma, addresses this burgeoning need by delivering comprehensive protection for cloud-based applications and workloads. As organizations transition to hybrid and multi-cloud environments, Palo Alto Networks is poised to capitalize on this market opportunity and drive revenue growth.

In summary, Palo Alto Networks presents a compelling investment proposition amidst the current market climate. With its leading cybersecurity technologies, financial strength, strategic acquisitions, and rising demand for cloud security solutions, the company is primed for sustained success and long-term growth. As businesses prioritize cybersecurity in an increasingly digital world, Palo Alto Networks remains a stalwart guardian against cyber threats, making it an appealing choice for investors seeking exposure to the cybersecurity sector.

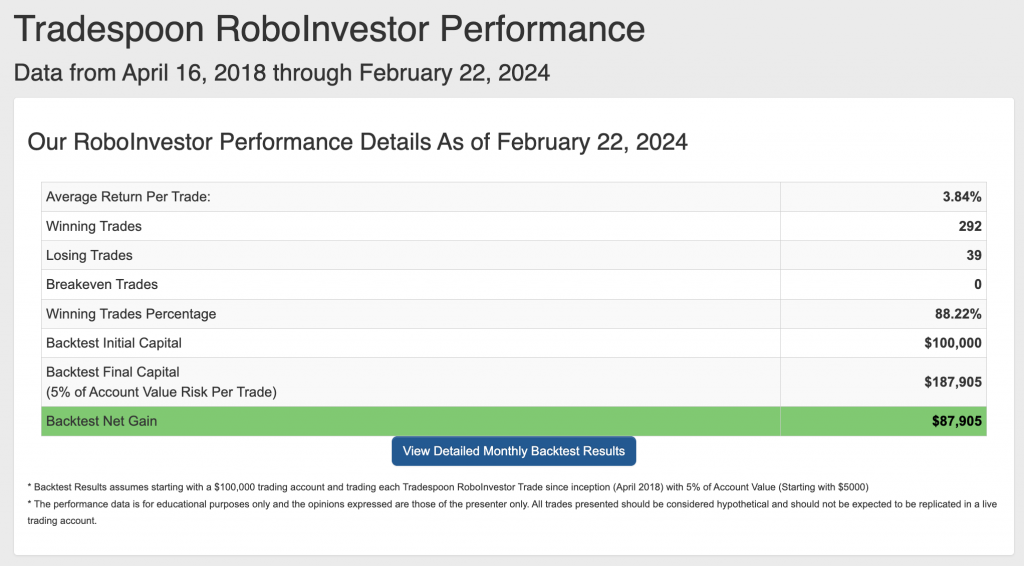

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step further into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!