After a brief setback on Wednesday, the stock market made a strong comeback on Thursday, propelling the S&P 500 into bull market territory. The upward momentum was primarily driven by two sectors: technology and consumer staples. However, investors found themselves reevaluating their predictions for a potential pause in interest rate hikes by the Federal Reserve, as other global economies moved in the opposite direction. As the market awaits the central bank’s upcoming decision, the focus on monetary policy is intensifying.

Market participants are eagerly awaiting the next interest-rate decision by the Federal Reserve, following their policy-setting committee meeting scheduled for June 13-14. Initially, expectations pointed towards a pause in rate hikes due to signs of economic slowdown and moderating inflation. However, recent moves by other central banks have shifted sentiments, causing investors to reassess their outlook. The surprise quarter-point rate hike by the Bank of Canada on Wednesday has raised questions about the future path of interest rates in the United States.

In a surprising turn of events, jobless claims climbed higher than anticipated last week. The Labor Department reported an increase of 28,000 claims, bringing the total to 261,000 for the week ending June 3. Despite this uptick, continuing jobless claims declined, highlighting the overall strength of the labor market. The Federal Reserve has been closely monitoring employment data as it seeks to address the persistent issue of high inflation. The central bank’s strategy of gradually raising interest rates is aimed at achieving a balanced labor market.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

On Thursday, global stocks experienced a modest upward drift, mirroring the lack of significant catalysts observed on Wall Street. However, there remains a sense of optimism driven by hopes for government stimulus measures to support China’s ongoing economic recovery. While markets lack clear drivers, the sentiment remains buoyed by the potential boost to global trade.

Oil prices initially gained momentum earlier in the week following OPEC’s decision to extend production cuts, which effectively reduced the available supply. However, the market sentiment quickly reversed after China, the world’s second-largest oil consumer, released discouraging trade data. Exports fell by 7.5% year over year in May, surpassing economists’ expectations for a more moderate decline. As concerns about weak demand from China overshadowed OPEC’s efforts, oil prices experienced a decline on Thursday. Additional pressure on prices stemmed from news related to Iran.

Investor attention is now turning toward upcoming Consumer Price Index (CPI) data and the Federal Reserve’s decision on interest rates. These events are likely to influence market sentiment and guide investment strategies in the coming weeks. As the market continues to trade sideways, increased volatility is expected during the second half of the year.

With Thursday’s stock market rebound fueled by strong performances in the technology and consumer staples sectors, we have turned our attention to a specific kind of trade. The upcoming decisions by the Federal Reserve and the release of key economic indicators will play pivotal roles in shaping the market’s trajectory in the near future. Given the recent pullback across various assets and regions, one potential trade idea for the upcoming week is to consider short-selling Europe, specifically EWG and VGK.

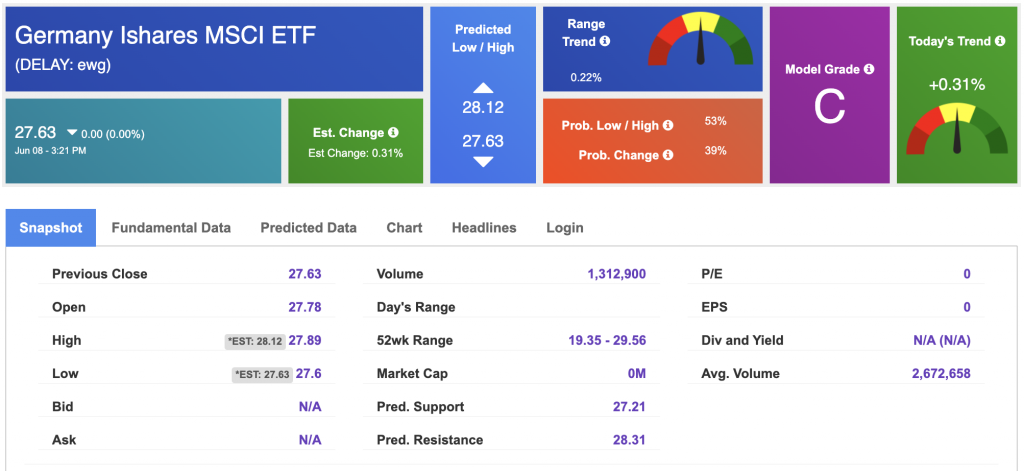

The iShares MSCI Germany ETF (EWG) is an exchange-traded fund that aims to track the performance of the MSCI Germany Index, offering investors exposure to a diversified portfolio of German stocks. Managed by BlackRock, it provides a convenient way to invest in Germany’s strong economy and diverse sectors. Investors should assess their goals and market conditions before investing in EWG.

Following the latest news from Europe, it appears volatility could be in store and we’ve already seen ETFs like EWG struggle during times of global uncertainty and market volatility.

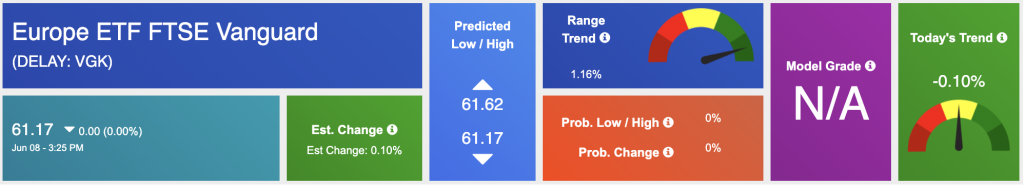

Vanguard FTSE Europe ETF (VGK) is an exchange-traded fund that aims to replicate the performance of the FTSE Developed Europe All Cap Index. It provides investors with exposure to a broad range of European companies across various sectors and market capitalizations. The fund is managed by Vanguard, a renowned global investment management company.

The FTSE Developed Europe All Cap Index represents the performance of large, mid, and small-cap stocks from developed European markets. It includes companies from countries such as the United Kingdom, France, Germany, Switzerland, and others. The index covers a diverse range of sectors, including financials, consumer goods, healthcare, industrials, and technology.

Investing in VGK allows investors to gain exposure to the European equity market as a whole. It offers a convenient way to access a diversified portfolio of European companies without the need to buy individual stocks. The ETF structure provides liquidity and flexibility, allowing investors to easily buy or sell shares on the stock exchange.

Shorting European markets has gained attention as investors analyze current market conditions. With uncertainties surrounding economic recovery, geopolitical concerns, and potential policy shifts, some investors are considering shorting European markets. Factors such as sluggish economic growth, political tensions within the European Union, and the current Ukraine-Russia war have contributed to the cautious sentiment. Additionally, concerns about rising inflation and the possibility of tighter monetary policy add to the rationale behind shorting European markets.

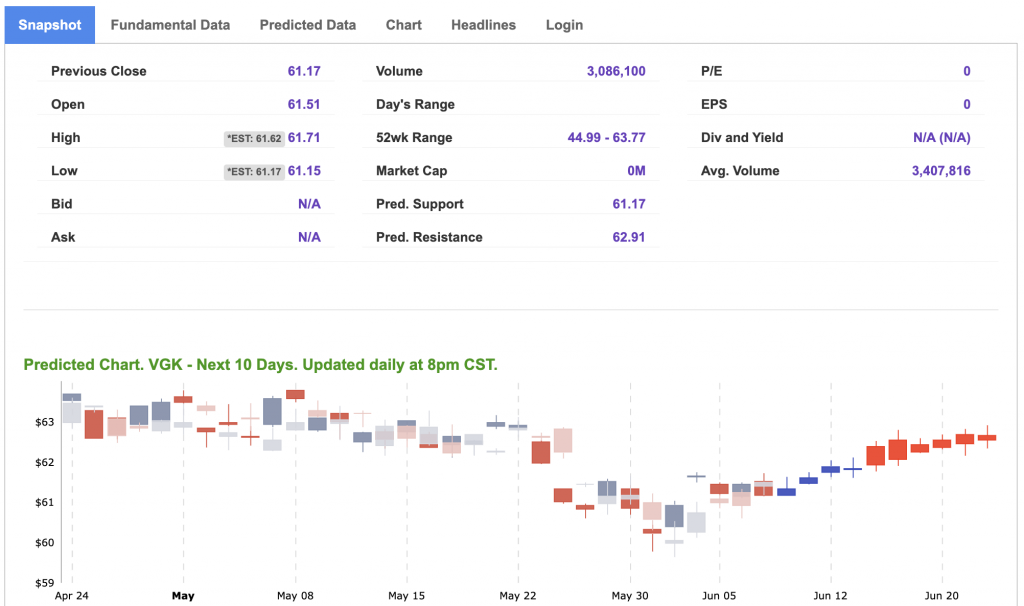

Reviewing our A.I. forecasted data we see several encouraging signals in regard to shorting European symbols. Both VGK and EWG have negative vector scores which indicate an immediate negative trend for the symbols. This momentum could further escalate with additional selloffs as well as news regarding the upcoming U.S. FOMC.

Throughout this tumultuous year, we have witnessed targeted retracements in various asset classes and geographical regions. These pullbacks indicate a more pervasive and widespread undercurrent of pessimism and selling momentum. While the U.S. markets have found stability after the resolution of the debt ceiling issue, Europe may not be as fortunate due to ongoing geopolitical uncertainties that weigh on global markets. Furthermore, the ramifications of the current circumstances in China seem to extend beyond initial expectations, adding another layer of concern to the mix.

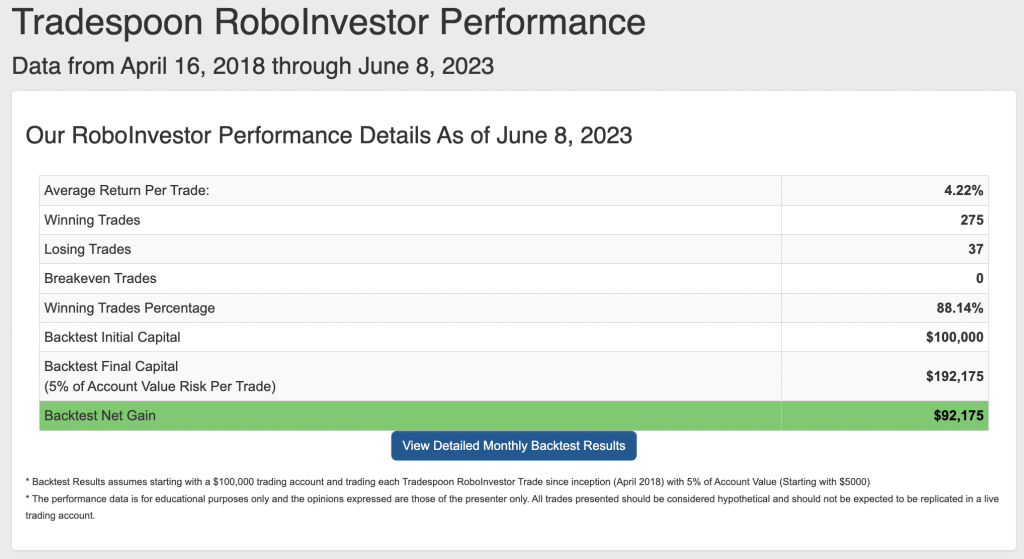

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.14% going back to April 2018.

As we embark into the second half of 2023, investors find themselves confronting a dynamic market characterized by a confluence of influences, including inflationary pressures, evolving Federal policies, and geopolitical tensions like the persistent conflict in Ukraine. In order to adeptly maneuver through this intricate landscape, it becomes imperative to align with a dependable and well-informed investment platform. RoboInvestor emerges as a trusted partner, offering an array of invaluable resources and expert guidance to empower investors in confidently managing their portfolios and seizing lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!