Kicking off the week with a surge of energy, Monday witnessed an electrifying performance as the three major stock indexes achieved unprecedented highs for 2023. This triumph not only extended the S&P 500’s impressive six-week winning streak but also showcased the index’s resilience amid the dynamic shifts in the economic landscape.

The noteworthy aspect of this feat lies in the backdrop of concerns regarding high-interest rates potentially impeding economic growth. Despite these apprehensions, the S&P 500’s ability to reach new highs reflects the market’s confidence, albeit cautiously, in the overall economic outlook.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

As the week unfolded, the market geared up for impactful data releases. Tuesday’s spotlight was on the consumer price index (CPI), with economists predicting a 3% year-over-year increase, a slight decrease from the previous month’s 3.2%. The market reacted positively as stocks extended their winning streak to four days, driven by a modest dip in inflation for November.

During this period, the S&P 500 reached an intraday high of 4630, marking a significant milestone for the year. Simultaneously, oil prices experienced a five-month low, and bond yields showed mixed trends, with the 10-year Treasury yield sliding to approximately 4.2%.

Investors closely monitored Fed-fund futures, signaling a shift in sentiment with reduced expectations for a March interest rate cut, now standing at a 50% likelihood for May. Despite a brief pause in U.S. stock futures on Monday, the market anticipated a busy week with significant economic data releases and the eagerly awaited monetary policy decision from the Federal Reserve.

Wednesday brought a surge in stocks following the Federal Reserve’s decision to keep rates steady, resulting in the Dow Jones Industrial Average closing at a record high. The central bank’s decision influenced lower Treasury yields and a weakened dollar. Earlier in the week, the producer price index for November rose less than anticipated, adding weight to the narrative of declining inflation.

Notable market movements included Apple stock reaching an all-time high, while Pfizer stock experienced a decline after releasing financial guidance for 2024 that fell short of investor expectations.

Approaching 2024, a market-neutral stance seemed prudent, considering potential short-term pullbacks. Indicators suggested a low likelihood of a recession, prompting a reassessment of the market outlook. The projected S&P 500 rally, potentially capped within the $450-470 range, was anticipated to find short-term support levels between 400-430 in the coming months. For reference, the SPY Seasonal Chart is shown below:

The Federal Reserve, as expected, kept interest rates unchanged after its policy meeting. The target range for the federal funds rate remains at 5.25-5.50%. Notably, officials signaled a tighter monetary policy for the upcoming year than initially expected, with further hikes appearing unlikely.

Thursday’s market showed positive reactions to the Federal Reserve’s signaling of potential rate cuts, following their decision to maintain steady interest rates. The Dow Jones Industrial Average closed at its second consecutive all-time high.

Dovish remarks from Fed Chairman Jerome Powell, coupled with projections indicating officials anticipate three rate cuts next year, bolstered market sentiment. The hints of cuts in 2024 sent the yield on benchmark 10-year Treasury notes below 4%, a level not seen since July. Tech stocks relinquished earlier gains, and prices of goods imported to the U.S. experienced a decline in November.

On the global front, the European Central Bank and the Bank of England kept rates unchanged in their final decisions of the year. European stocks pared earlier gains after the ECB hinted that a first rate cut is more likely in June or beyond, rather than early 2024.

Most market participants now believe that the Fed is done raising rates this year and next, with a high probability of starting to lower interest rates in the first half of 2024. This sentiment is perceived as bullish for the market, with high BETA risk-on asset classes continuing to rally and outperform the magnificent seven stocks.

Market indicators, such as the DXY and longer-dated treasuries, signaled a weakening trend, dropping below the 50 DMA and approaching the 200 DMA. The prevailing expectation is that, as long as the dollar remains weak and yields continue to trend lower towards the end of the year, the rally is poised to persist.

The majority of market participants foresee lower yields in H1 of 2024. However, the scenario might differ if inflation remains higher for an extended period, potentially delaying interest rate reductions until H2 of 2025—an aspect not fully factored into current market evaluations.

Amid the current consensus suggesting a trajectory of lower highs and lower lows in interest rates, sectors like banks, industrials, and early cyclicals are emerging as potential winners in the market landscape. This trend aligns with the prevailing belief that the Federal Reserve is poised to maintain a dovish stance, providing a favorable environment for these sectors to thrive.

As interest rates remain on a downward trajectory, banks stand to benefit from reduced borrowing costs, potentially boosting their profit margins. Lower interest rates often translate into increased lending activity, supporting the financial sector’s growth. Investors eyeing banking stocks may find this trend an opportune moment to delve into this sector, keeping a keen eye on well-positioned financial institutions.

Industrials, closely tied to economic activity, tend to flourish when interest rates are lower. This environment can stimulate spending on infrastructure projects and capital investments, benefiting companies within the industrial sector. Investors with an eye on long-term growth may find opportunities within industrials as the market adapts to the anticipated economic shifts.

Early cyclicals, often sensitive to economic fluctuations, can also thrive in a scenario of lower interest rates. As monetary policy signals favor a cautious and accommodative approach, these sectors may experience increased consumer spending and business investments. Identifying promising early cyclicals can be a strategic move for investors looking to capitalize on the current market sentiment.

Boeing ($BA): A Standout Opportunity in the Market Landscape

Amid these market dynamics, Boeing ($BA) emerges as a compelling buy, aligning with the broader trends outlined above. The aviation giant, operating within the industrial sector, stands to benefit from increased global economic activity and lower borrowing costs. The dovish stance of the Federal Reserve and the overall positive market sentiment provide a conducive backdrop for Boeing’s growth prospects.

Boasting a robust track record and positioned as a key player in the aerospace industry, Boeing’s potential to navigate the current market conditions makes it an attractive investment option. As the market leans towards sectors favored by lower interest rates, Boeing’s resilience and potential for expansion in a recovering global economy make it a standout opportunity for investors seeking growth and stability in their portfolios.

Investors considering Boeing as part of their investment strategy should conduct thorough research, considering both market conditions and the company’s financial health. However, based on the current market landscape, Boeing presents itself as a promising candidate in the realm of stocks positioned to capitalize on the ongoing economic shifts and the Federal Reserve’s monetary policy stance.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

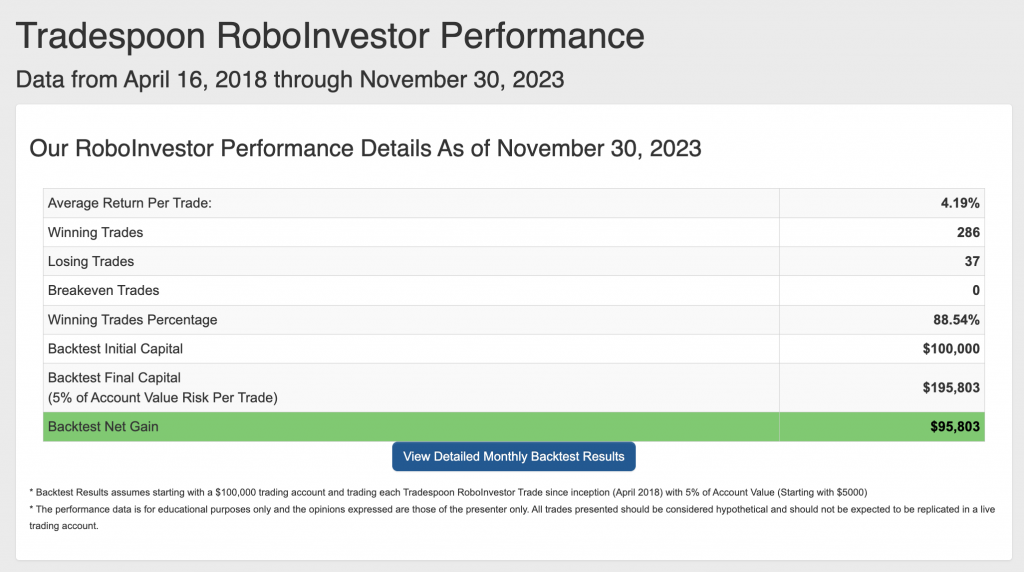

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we enter Q4 comes to a close, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!