U.S. stocks rose today in advance of a busy week that includes new data on inflation and the midterm elections, which will determine control of Congress – as well as the final stretch of earnings season for companies reporting third-quarter results. On Tuesday, midterm elections are due to take place and likely provide clarity on political majority control within the congressional branch. This week will also feature marquee inflation data, set to release on Thursday, with the latest CPI readings. Finally, earnings season is on its last legs with AMC, Disney, and a handful of retail and energy-related brands reporting this week.

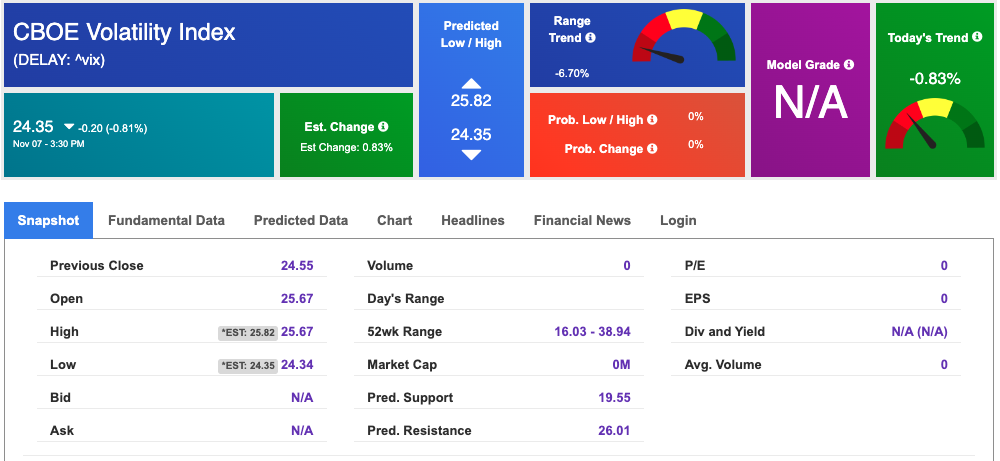

Just last week, the latest Fed policy update saw a 75 basis point interest rate hike with additional guidance towards future Fed moves. This sent markets lower, coupled with labor data which continued to show robust employment. Looking ahead, it remains unclear how to Fed will proceed exactly, however, rate hikes are still expected. Globally, Asian markets finished impressively higher while European markets closed with mixed results. The $VIX is trading near the $24 level, off its recent highs, and the commodities are on the move lower.

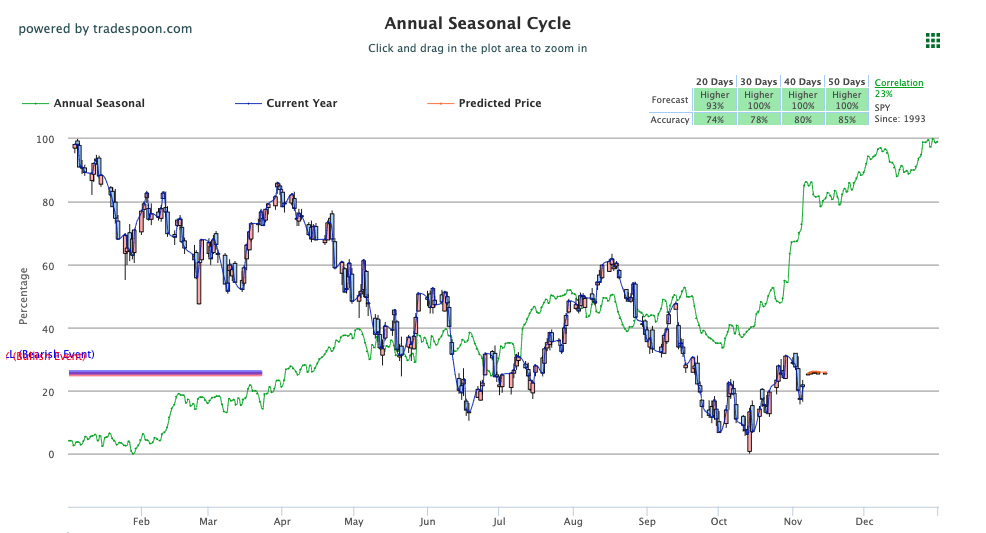

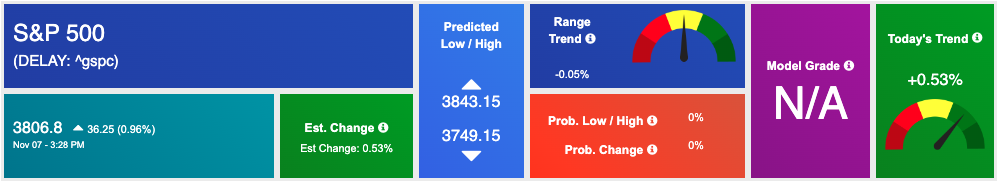

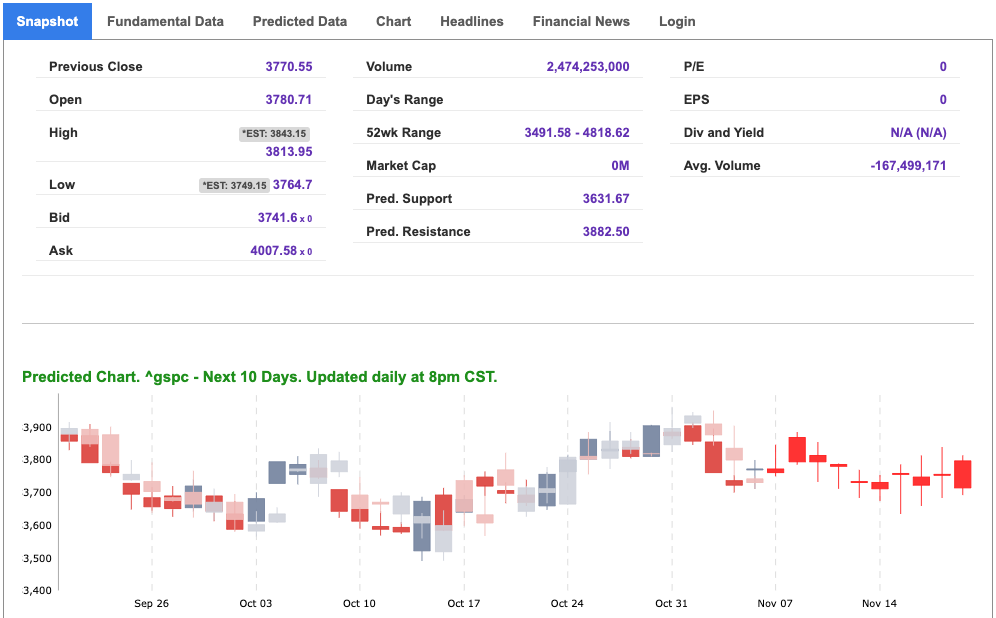

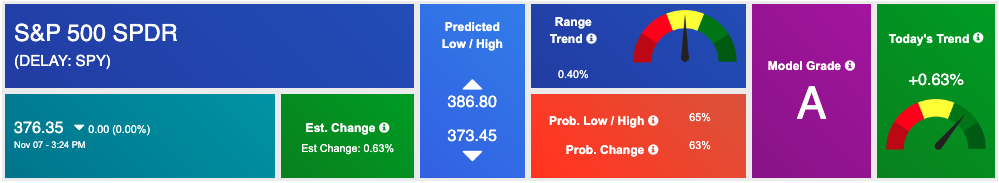

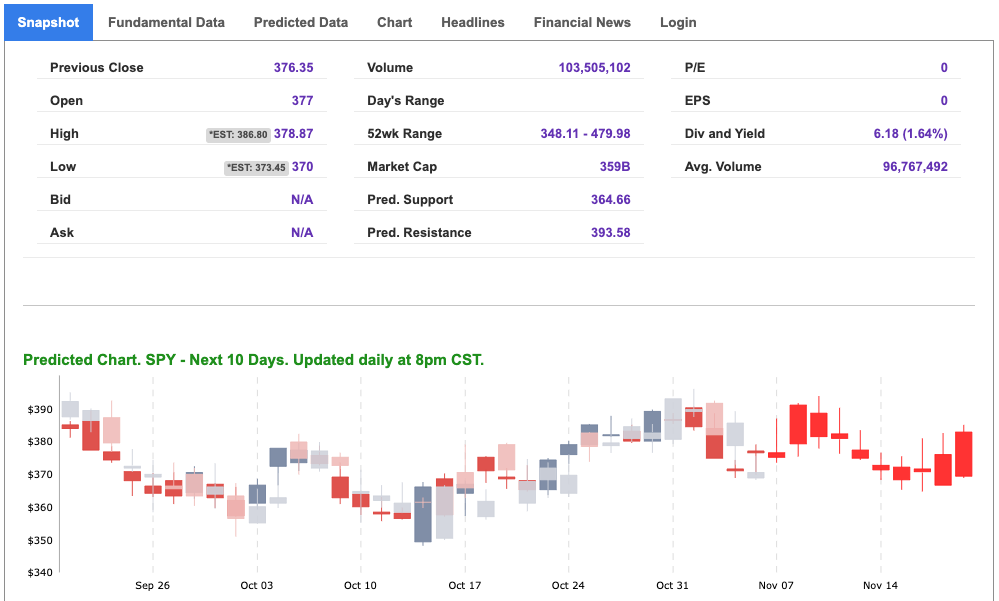

We are monitoring the SPY’s overhead resistance levels, which are currently at $390 and $400. The support for the SPY is $374 and then $367. Based on our current analysis, we anticipate that the market will continue its rally for the next few weeks. However, because the short-term market is currently overbought, there is a chance it may pull back before continuing to rise. We would be a buyer into any further sell-offs and encourage subscribers not to chase the market to the downside or upside. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

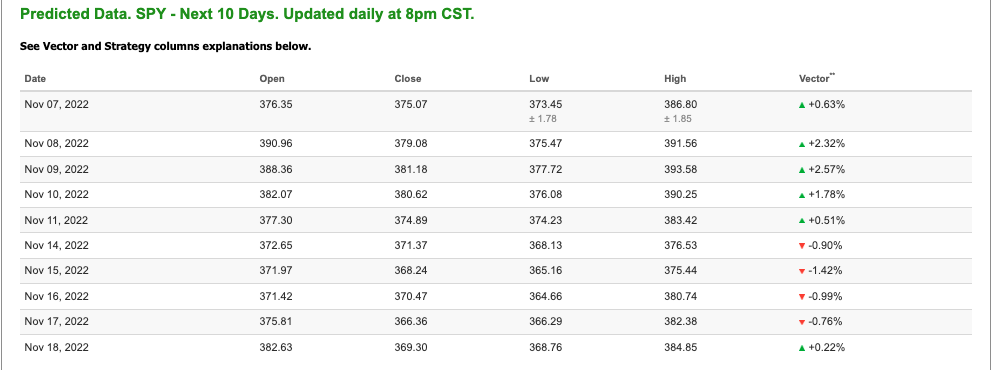

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SPY. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

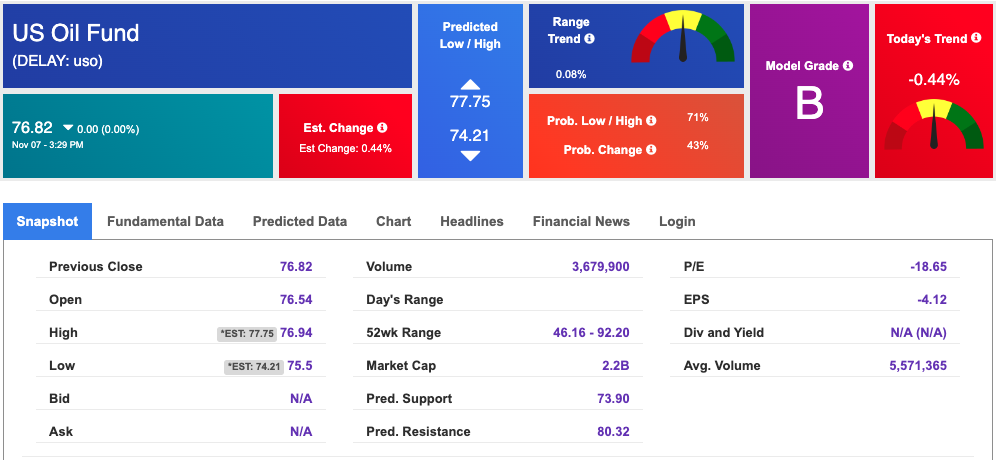

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $91.81 per barrel, down 0.86%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $76.82 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

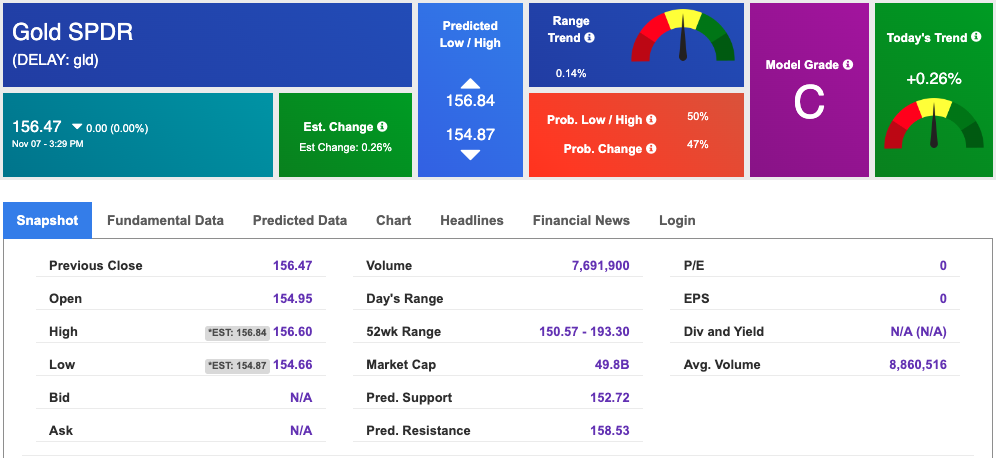

The price for the Gold Continuous Contract (GC00) is down 0.05% at $1677.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $156.47 at the time of publication. Vector signals show +0.26% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

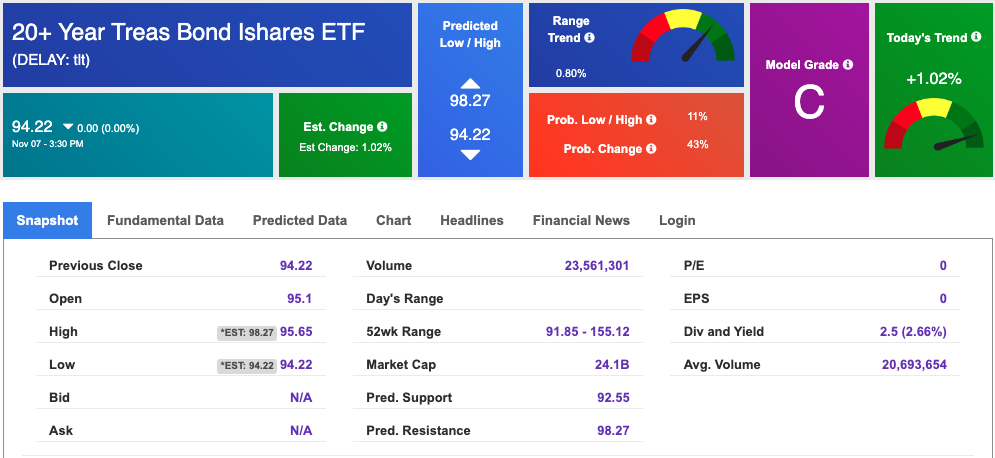

The yield on the 10-year Treasury note is up at 4.218% at the time of publication.

The yield on the 30-year Treasury note is up at 4.326% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is $24.35 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!