Ahead of Friday’s Jackson Hole Economic Symposium, where Fed Chair Jerome Powell is due to speak, all three major U.S. indices closed in the green for the second straight positive session. Investors will look at Powell’s remarks for indicators regarding the Federal Reserve’s policy, which has been a concern in regard to mounting inflation and recession fears.

Despite the concerns about economic growth, market sentiment is that Powell will urge for more aggressive interest-rate hikes in order to combat inflation. Ahead of Powell’s comments, investors should look out for the Core PCE data set to release on Friday providing additional inflation and market guidance.

On Thursday, we also saw unemployment data released which fell to a one-month low of 243,000 unemployment applicants. Revamped GDP data for the U.S. was also released and supported markets as U.S. stocks ended near session highs on Thursday. A second-quarter GDP reading was revised downward to 0.6%, better than the initial estimate of 0.9%.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

Looking at the current market conditions, I remain in the belief that the market has been experiencing a rally and that the bear market is due to resume. Strong earnings have continued to support stocks while all eyes now turn to Fed Chair Powell’s comments at the Jackson Hole meeting. Economic reporting has supported this notion but should be continuously reviewed.

Service and manufacturing PMI reports point to a contraction of global economies, as well as the U.S. and with confirmation of a second straight GDP slump, markets could now see added pressures. The next GDP report will be key as we’ve never seen three straight down quarters and not faced a recession.

Another key point in the recent rally coming to an end is the dollar rally as the $DXY, the dollar index, hit a 20-year high. In contrast, the Euro has fallen below. It is our opinion that the market has been top building and that the sell-off could resume sooner than later.

With mega-cap tech stocks starting to show some weakness, as AAPL and others are affecting SPY/QQQ growth, I am looking at a specific set of ETFs to trade in the coming weeks. I am expecting the potential restart of the bear market to resume in the next two-three weeks and Friday’s Jackson Hole comments will be a key indicator of market direction.

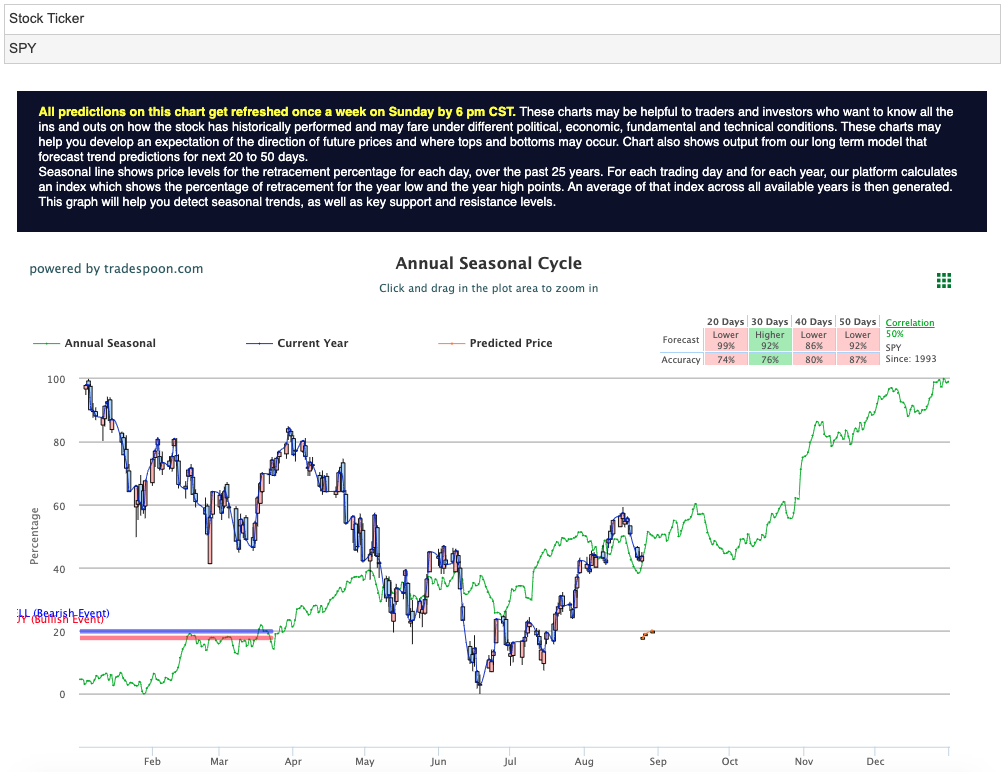

I am watching the overhead resistance levels in the SPY, which are presently at $417 and then $422. The $SPY support is at $406 and then $398. I expect the market to continue the current pullback for the next 4-8 weeks and I would be a seller into any further rallies, as well as encourage subscribers not to chase the market at these levels.

I’m looking at one symbol that has the potential to have an exceptional outcome as a result of this most recent earnings season, after analyzing the present market conditions along with my A.I. toolset. This symbol is not only in line with the most current trends, but I also see several signs indicating that it would succeed based on past performance.

As the market is currently overbought, I am looking into several ETFs to short major indices that are primed for a pullback at this time. Specifically, two of the leading ETFs in this field.

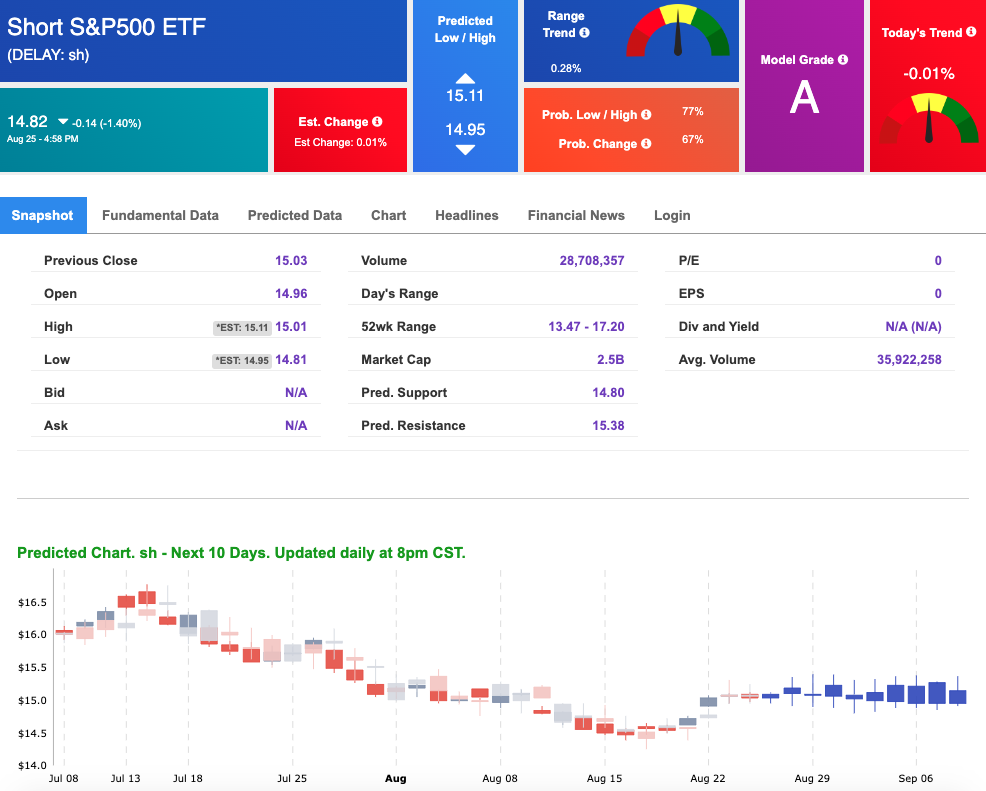

ProShares Short S&P 500 (SH) is an ETF intended for shorting the S&P 500, which consists of large-cap U.S. stocks. Currently managing over $2.5 billion in assets, this ETF has been trading in the $14-$15 range, below its 52-week high of $17.20.

The best part of the rally is behind us. Earnings are also predominantly behind us. This makes the short ETF a unique opportunity ahead of the next FOMC meeting and likely interest rate hike.

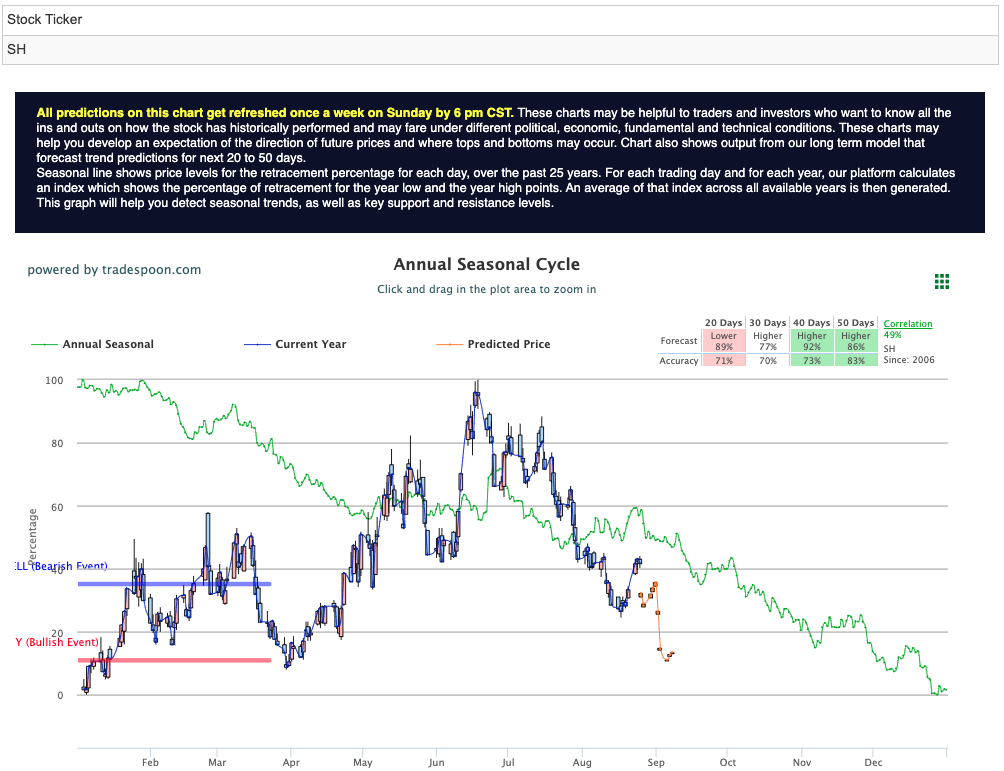

Reviewing the $SH Seasonal Chart, we see that there is a gap between the annual season price, marked in green, and the current year price, marked in blue. The symbol is showing potential to go higher in the next 30, 40, and 50-day ranges with a decently high forecast percentage. See $SH Seasonal Chart below:

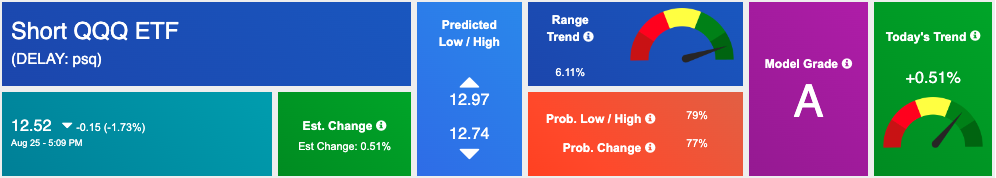

Another good opportunity to short the market as we move away from the latest rally and likely back into a bear market is ProShares Short QQQ ETF (PSQ).

PSQ aims to short Nasdaq and tech-based companies which as we’ve previously stated are showing some weakness and are a leading indicator of market direction. With just under $1.3 billion in assets, this ETF is also primed for a great run if the market is to resume its bear-natures.

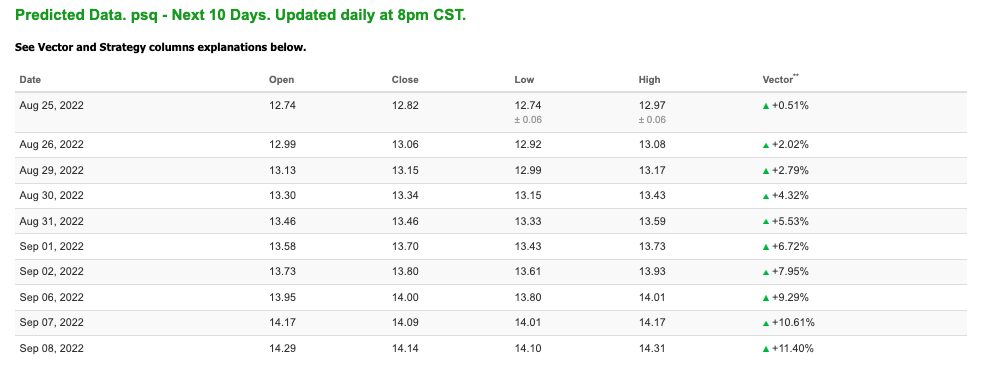

Looking at our A.I. tools, PSQ, like SH, is also seeing great trends for an uptick based on historical data and the latest trends.

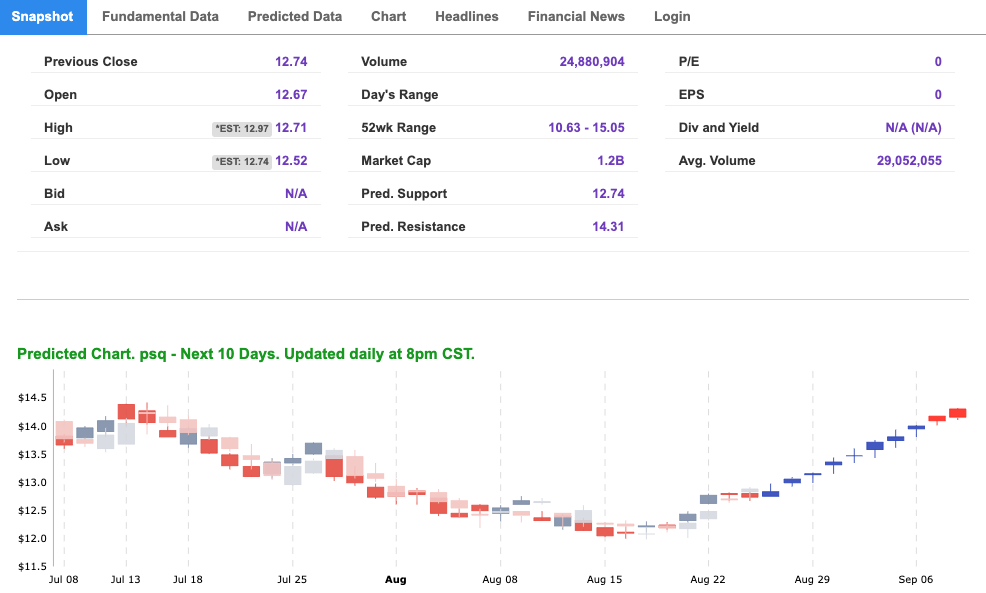

Using the Stock Forecast Toolbox, PSQ is signaling a continuous trend upward in its 10-day forecast. The symbol is trading below its 52-week and monthly highs and has potential for the upside. PSQ nearly hit $15 this June and is currently trading in the $12-$13 range. The overbought nature of the market makes this symbol path of least resistance up and our A.I. tools are showing just the same!

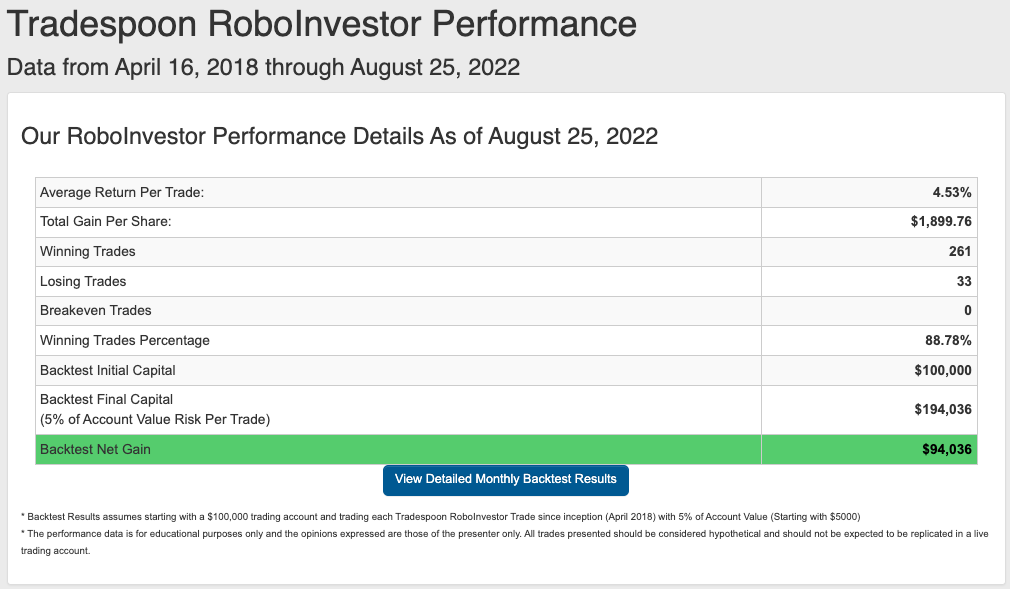

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.78% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we still have more than 3 months to go! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!