Stocks saw a volatile session on Thursday as investors digested the Federal Reserve’s interest rate hike and the recent turmoil in the banking sector. The markets took a downturn just before the House Budget and Oversight Hearing, where Treasury Secretary Janet Yellen delivered her prepared remarks, noting that the government had acted quickly to prevent further contagion and will continue to do so as necessary.

The banking sector has been under pressure since the collapse of Silicon Valley Bank and Credit Suisse this month. Yellen’s comments on Wednesday about the banking turmoil, following the Federal Reserve’s announcement of its latest rate hike, drove bank shares lower, sparking investor concern. This continued on Thursday with all three major U.S. indices set to finish the week in the red.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Wednesday’s Federal Reserve announcement of a quarter-point rate hike appeared to be in line with expectations, however all three major US indices swiftly sold off and closed down 1.6%. Though this change was intended to minimize inflation risks as well as bank turmoil, investors were unnerved by both Jerome Powell and Janet Yellen’s comments on the banking sector.

The Federal Reserve and other central banks have extended their US dollar swap line arrangements in an attempt to boost liquidity across global funding markets. The recent turmoil in the banking sector has left investors focused on the implications of the Fed’s monetary policy. The Fed’s policy-setting committee is scheduled to meet next week, and traders have already priced in a more accommodating stance from the central bank, given the banking panic.

Chairman Powell acknowledged the turmoil in the US banking sector, stating that the issues were limited to a few banks and that the broader financial system was “sound and resilient.” However, both Powell and Yellen stopped short of guaranteeing that all depositors would be saved in the event of further bank failures, causing a dip in the stock market.

The market has been experiencing a run on the banks, with liquidity issues in credit markets. This has widened the spreads across different credit structures, leading to a lack of liquidity in treasuries and historical moves in the 2-year treasury, all pointing to credit issues and a high probability of a recession. The Fed futures now point to a 100 basis-point rate drop by the end of the year, and the Fed is most likely to pause sooner than was initially expected.

JP’s speech and the 0.25% rate hike have brought attention to regional banks and liquidity issues. The European Central Bank has stated that “not much progress has been made on inflation.” The CPI from England (February data) continues to rise, and there are concerns about inflation. The narrative is changing from a soft landing to a hard landing, with standard correlations between the Treasury market and equity market now present. When there is bad news, it is bad for the market, and good news is good for the market going forward, unlike in the past 15 months.

Credit liquidity has been the major theme for markets this week, with the 10-year yield breaking below its December lows. The average investor is contemplating whether to keep their money in market funds with no risk or in equities with the risk of a 20-30% pullback. The DXY has been getting stronger over the past few sessions, and the 2-year yield is dropping drastically, comparable only to that seen on Black Monday in 1987.

The recent disconnect between the bond, currency, and equity markets has raised concerns. It remains to be seen if the equity market will follow the precipitous drop in the two-year yield, or if the two-year yield will follow the resilient stock market. For now, it appears that those who predict a hard landing have the upper hand.

Investors are advised to be cautious in these volatile times and to consider seeking advice from financial professionals before making any major investment decisions. With this in mind, I have selected a symbol that I will be keenly interested in for the coming week – but first, let’s break down our AI forecasts.

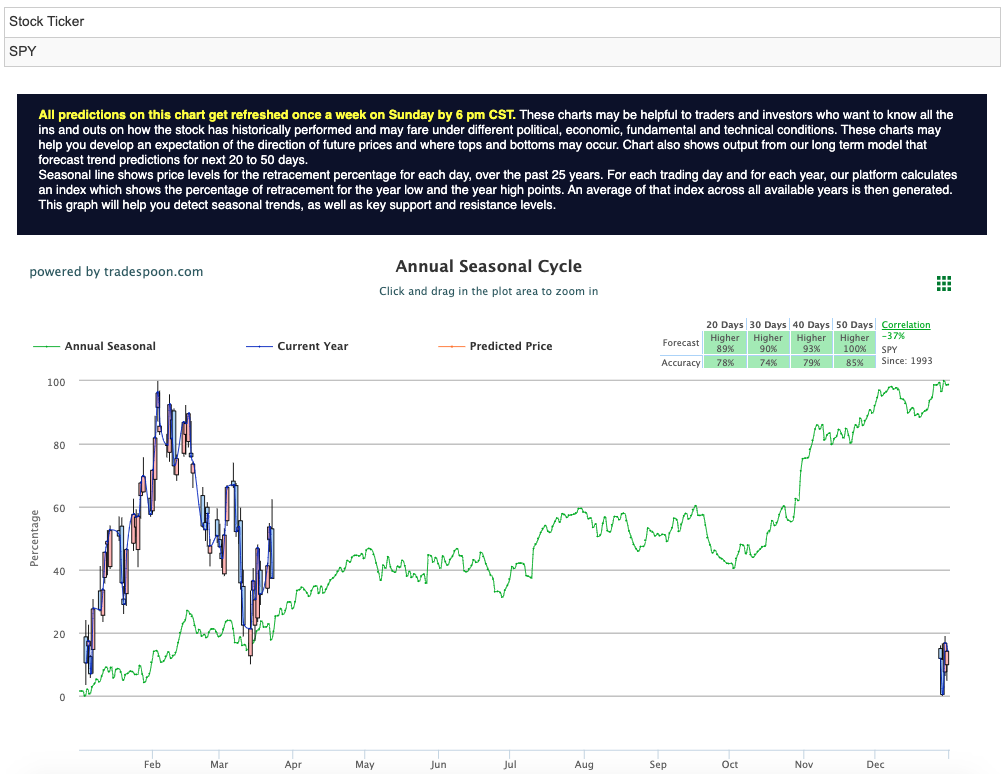

The VIX is currently trading near $22, while support for the SPY is at $392, followed by $384; overhead resistance levels are at $402 and $408. We still believe the market will trade sideways for the next two to eight weeks and recommend subscribers hedge their positions. For reference, the SPY Seasonal Chart is shown below:

I will be keeping a close eye on earnings reports this week from companies such as Nike and Chewy, as well as liquidity issues in regional and global banks, and the response to the Federal Reserve’s decision to influence markets. I still believe the market will trade sideways for the next two to eight weeks and recommend readers hedge their positions. As stated above, at the moment I maintain a bearish stance on the market due to recent developments and advise exercising caution.

With this in mind, I have selected my next RoboStreet symbol.

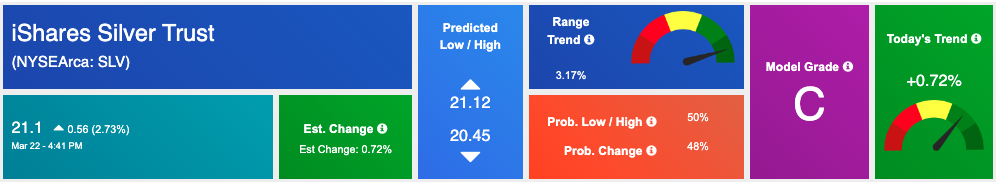

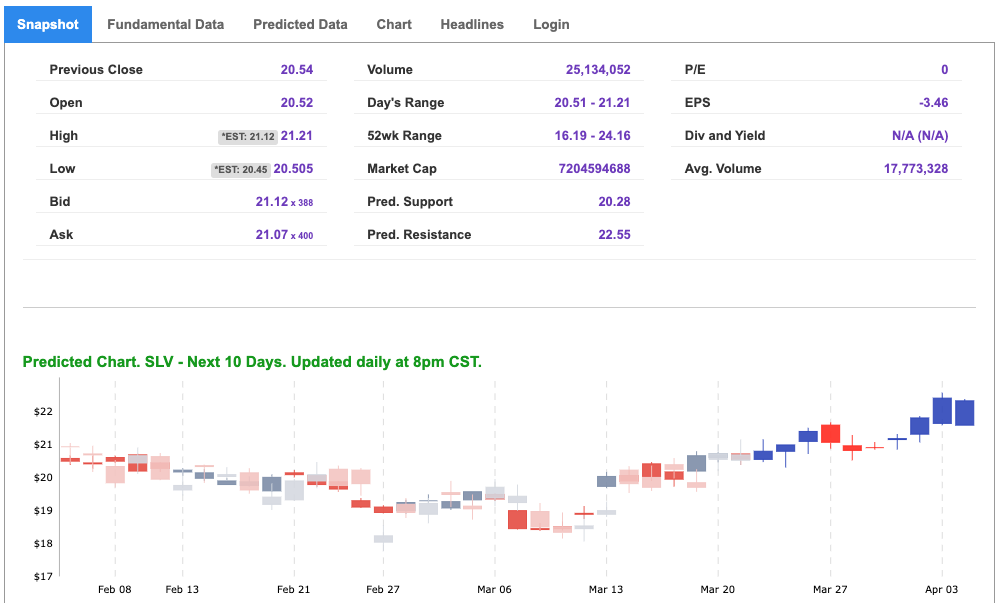

iShares Silver Trust (SLV) is an exchange-traded fund that aims to track the spot price of silver. The ETF is managed by BlackRock, Inc. and was launched in 2006. Investing in SLV provides investors with exposure to physical silver without having to purchase and store the metal themselves. The fund holds physical silver bullion in vaults, and the value of each share of SLV is equivalent to a specific amount of silver. The value of the ETF is directly influenced by the price of silver in the market – and as we have seen these past few days, that can prove profitable.

Looking at the 10-day forecast for SLV, we see a strong, one-directional, and positive vector trend. This is the kind of forecast I look for when selecting picks that I believe could rise and have plenty of room to the upside. Trading near the lower half of its 52-week range and rallying in recent days shows that SLV has room to grow and could continue to do so under current market conditions.

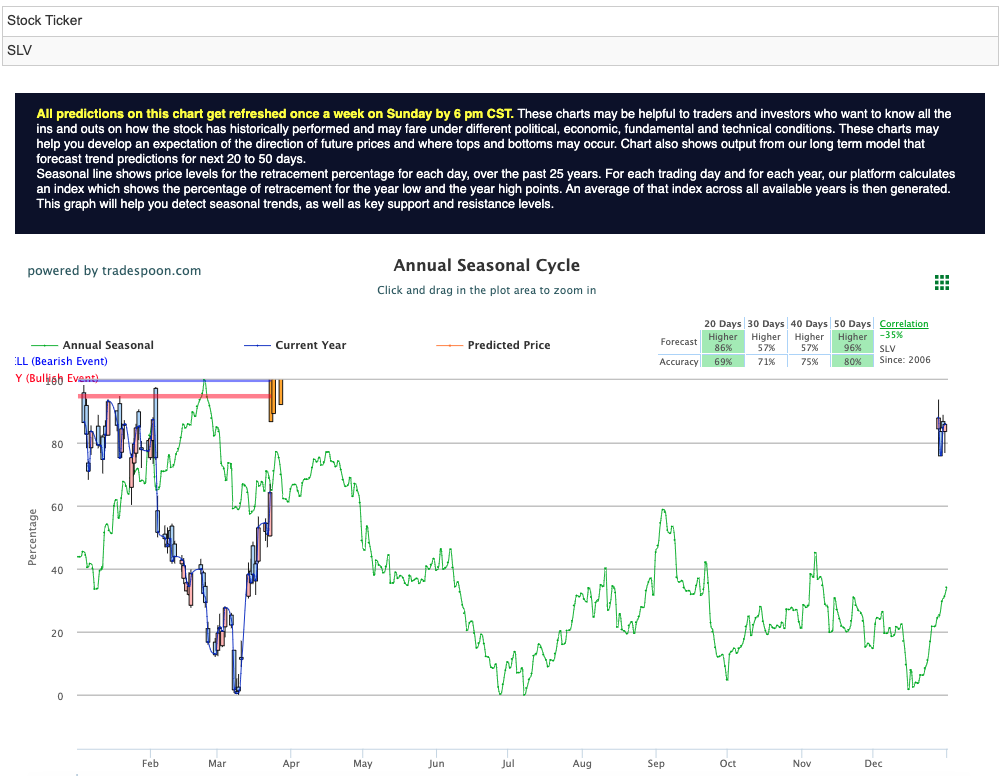

Likewise, our tool for long-term forecasts, the Seasonal Chart, is flashing all four time ranges to trade higher for SLV with a fairly high accuracy score. With both tools indicating that the symbol will likely trade higher, my confidence in SLV during the current trading climate has only increased. See $SLV Seasonal Chart:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

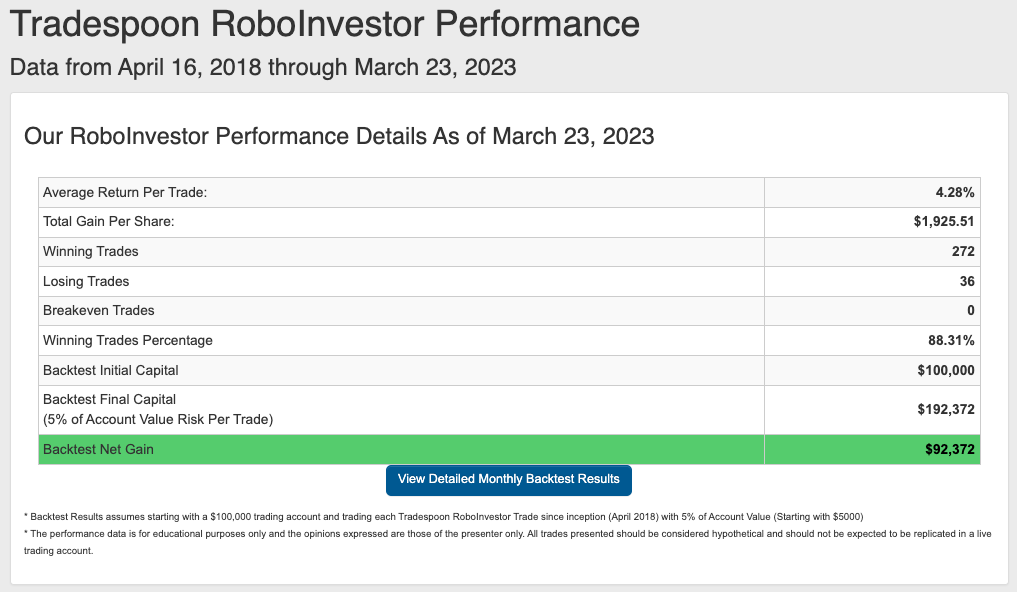

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!