U.S. stocks tumbled on Thursday following words of caution from Federal Reserve officials. As if that weren’t enough, the latest economic data on jobless claims and inflation only added to their concerns. Adding to the mixed messages, Treasury yields are rising, while producer-price inflation is giving the markets more to ponder about. Adding to the bad news, housing starts also dropped by 4.5% in January, signaling a slump in the housing industry. With all these developments, investors and analysts are keeping a close eye on the markets, trying to decipher what these economic indicators mean for the future of finance.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The highly-anticipated release of the CPI data on Tuesday revealed that consumer price growth is decreasing. However, the report indicated that the progress made in curbing inflation is slower than expected, and the path ahead may be uncertain. These findings highlight the challenge faced by the Federal Reserve in its efforts to alleviate inflationary pressures, as it may need to continue implementing measures to contain the rising prices.

In addition, the Consumer Price Index data for January showed a smaller-than-anticipated decline in the annual rate of price growth, along with the most significant monthly increase in prices since June. This finding underscores the need for ongoing monitoring of inflationary forces in the current economic environment.

On Wednesday, the latest retail report was released, revealing that retail sales in January exceeded expectations, indicating that consumer demand remains robust despite the challenging macroeconomic climate. Retail sales grew by 3% from the previous month, reaching a total of $697 billion, surpassing the anticipated 1.7% growth. Even excluding the volatile categories of vehicles and gas, sales still showed a significant increase of 2.6%, surpassing the predicted rise of 0.45%. These positive retail sales figures suggest that consumer spending remains strong, despite the ongoing concerns about rising inflation.

On Thursday, all three major U.S. indices finished in the red, following comments from St. Louis Fed President James Bullard and Cleveland Fed President Loretta Mester, which supported the notion that the Federal Reserve may have to continue raising interest rates to combat persistently high inflation. According to reports, Bullard stated that he cannot rule out a 50 basis point hike at the March meeting. Similarly, Mester emphasized the need to raise the federal funds rate if inflation continues to remain high or if imbalances between demand and supply persist. With investors digesting mixed signals from recent economic data, the future of Federal Reserve monetary policy remains a crucial factor for the markets. These developments serve as a reminder to investors that ongoing inflation concerns could potentially impact the trajectory of the economy in the coming months.

Furthermore, the latest labor data, released on Thursday, revealed that the number of initial jobless claims filed by Americans last week was 194,000, which was below economists’ predictions of 200,000. This positive development in the labor market is something that the Federal Reserve has been keenly monitoring to help address the rising inflation. The strong labor market data could help the Fed in its decision-making process as it weighs its options on whether to continue raising interest rates.

On the other hand, the producer price index, which is used to measure wholesale inflation, slowed to 6% in January compared to last year, indicating a decline from December’s figures but still higher than economists’ expectations. This data follows earlier news this week that consumer prices declined less than what was anticipated. These developments suggest that the inflationary pressure on the economy remains a major concern, and the Federal Reserve will need to remain vigilant in managing the situation going forward.

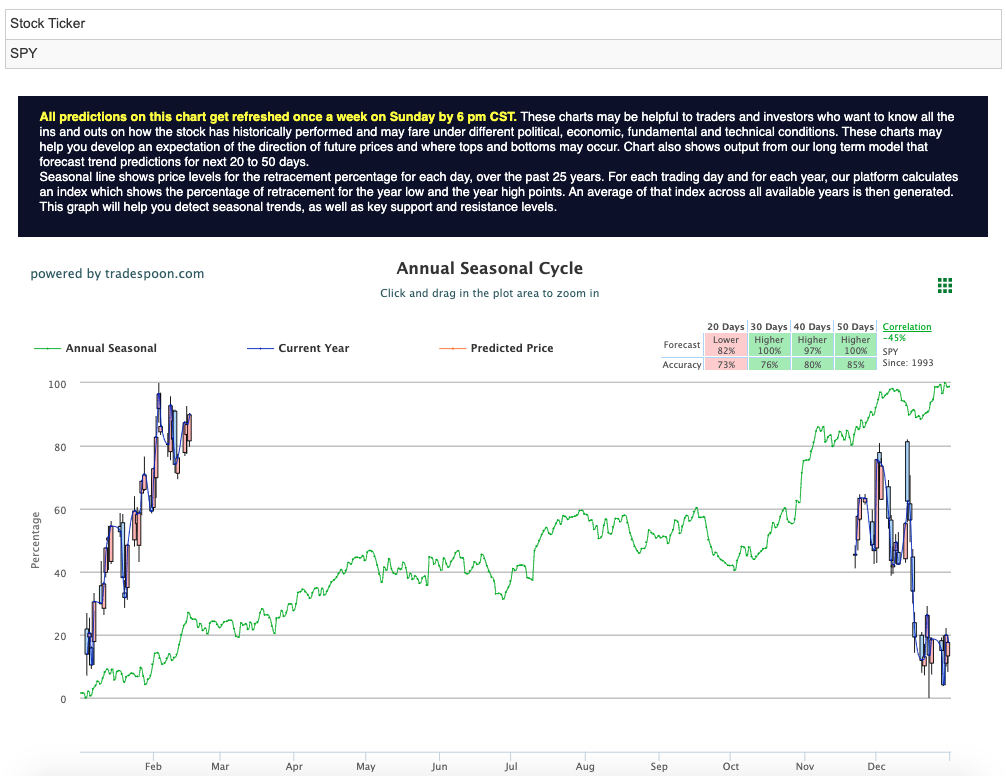

At the present moment, we are monitoring the ceilings of SPY at $420 and $430. The support level lies at around $410 and then follows up with a secondary one at $402. We predict that during these next few weeks (2-8) trading will remain static. At this time, we are looking to stay market neutral by hedging your positions. See the $SPY Seasonal Chart above.

Considering all this, our team has been scouting a particular asset that can be taken advantage of in the coming week!

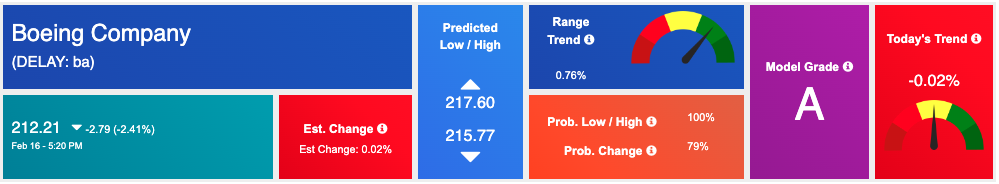

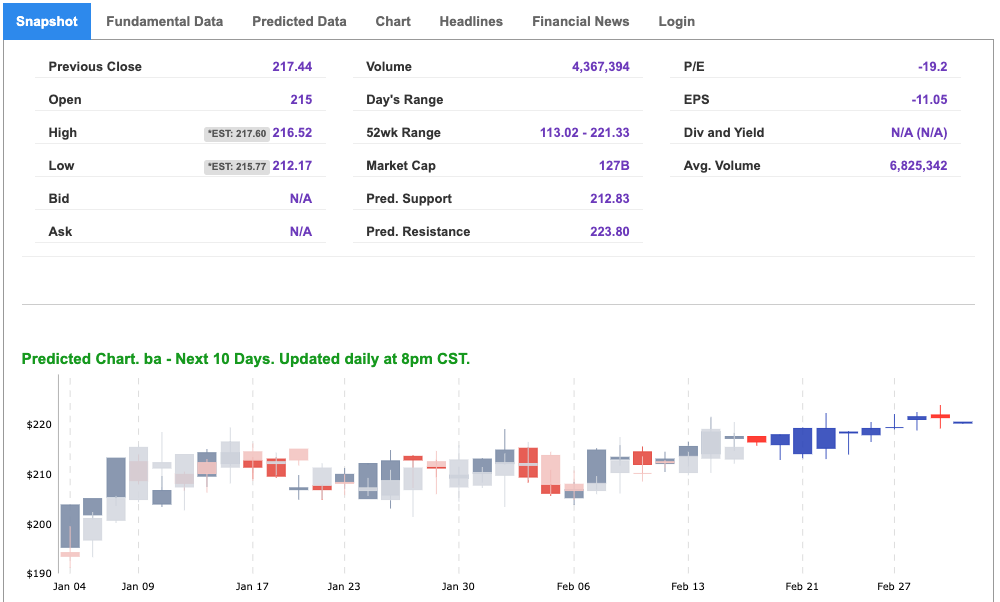

Boeing (BA) is an American multinational corporation that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, and missiles; it is one of the most closely watched in the aviation industry. Boeing’s stock price can be influenced by a variety of factors, including changes in the global economy, shifts in the aviation industry, geopolitical events, and regulatory developments.

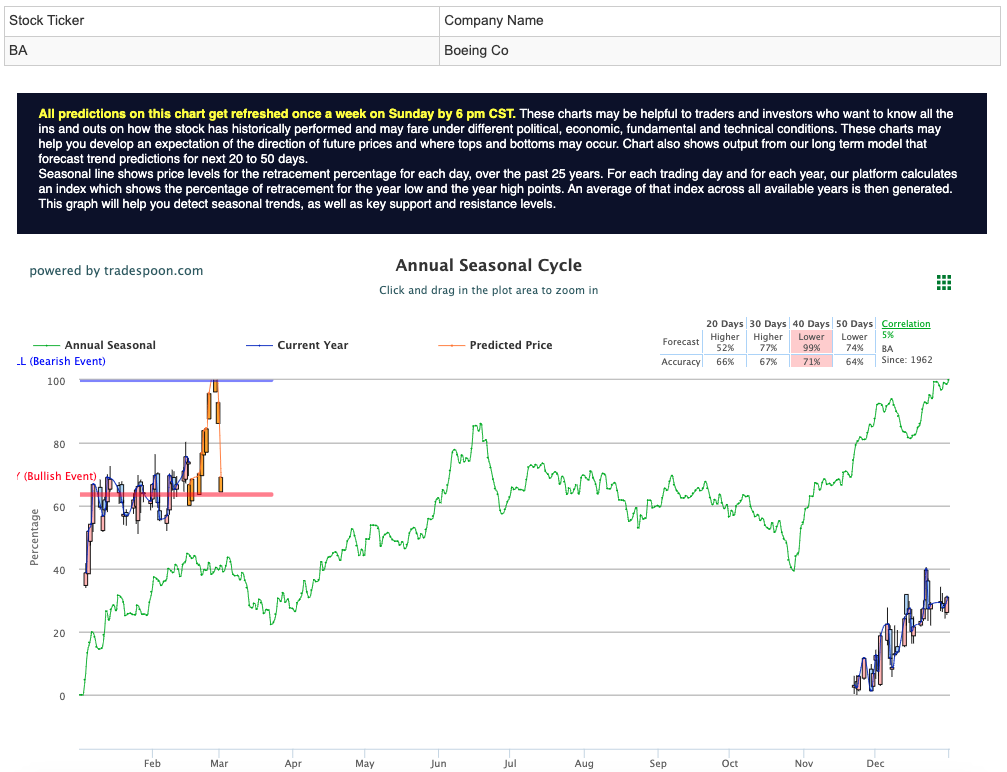

Boeing has performed well in recent weeks, and our A.I. data is not seeing a slowdown in the symbol. Looking at our Seasonal Chart tool, which is intended for longer-ranged predictions, Boeing is showing several impressive signals. First and foremost, the symbol flashes two time periods for the aviation stock to grow right out of the gate! With the 20- and 30-day periods signaling “higher” and the annual data pointing to a likely scenario, I will be looking to add BA this week! See the $BA Seasonal Chart below:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

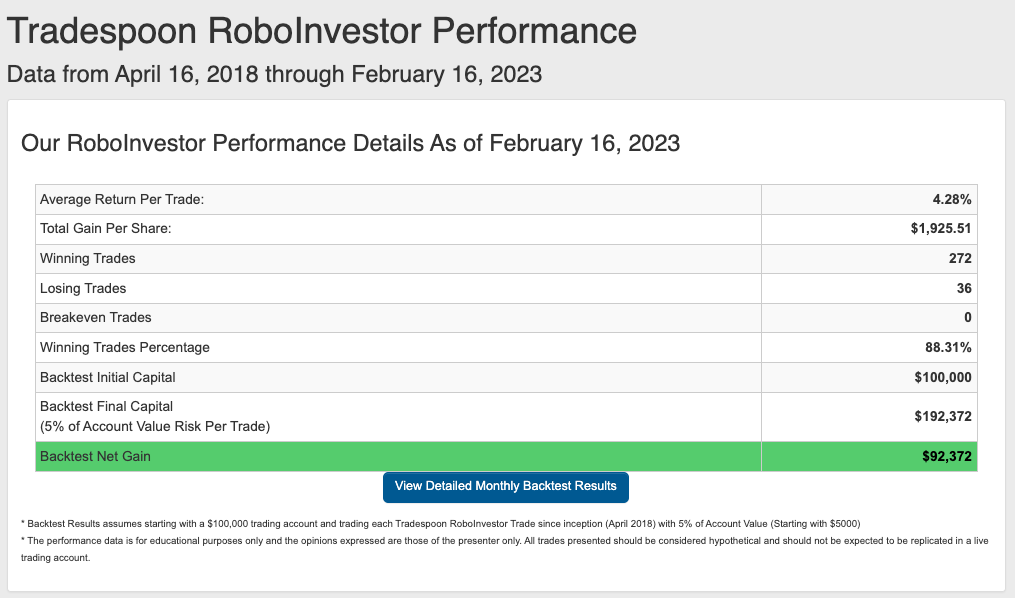

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!