After a positive start to the week, major U.S. indices took a downward turn, closing the week in the red. Following last week’s Federal Reserve decision, attention shifted to various Fed speeches and the upcoming PMI data on Friday. On Wednesday, markets experienced losses as investors digested Federal Reserve Chairman Jerome Powell’s hawkish remarks before the U.S. House Financial Services Committee. Powell’s comments on the long road ahead in combating inflation and the likelihood of future policy tightening contributed to the decline in stock prices.

Thursday saw Wall Street continuing its downward trend for the third consecutive day, with concerns about global growth coming to the forefront. The focus remained on central banks, as Powell testified once again. In the United Kingdom, inflation surprised economists by remaining unchanged in May, with consumer prices standing 8.7% higher compared to the previous year, defying expectations of a decline to 8.4%. To address this worrisome inflation, the Bank of England implemented a larger-than-expected rate hike, aiming to tackle the highest inflation within the G-7.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Additionally, on Thursday, initial jobless claims in the United States remained flat from the previous week, slightly exceeding economists’ predictions. The U.S. Department of Labor reported 264,000 new claims for the week ending June 17, falling within the range of expectations of around 260,000 claims.

In other news, the Federal Trade Commission filed a lawsuit against Amazon (AMZN) for allegedly enrolling consumers in Amazon Prime without their consent and making it difficult to cancel subscriptions. FedEx (FDX) experienced a slip in its stock price due to disappointing guidance. Major tech companies also saw their shares decline, while the Dow Jones Industrial Average showed slight gains thanks to positive performances from UnitedHealth Group, Honeywell, and Caterpillar.

Looking ahead, market attention will shift to the upcoming PCE data scheduled for release on Friday, the 30th. Market conditions continue to exhibit volatility, and it is anticipated that the second half of the year will bring further fluctuations. Given the pullback across various assets and regions, there is a focus on short-selling Europe, specifically EWG and VGK.

And our A.I. models agree!

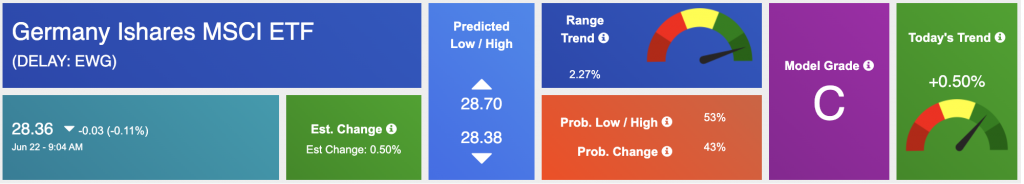

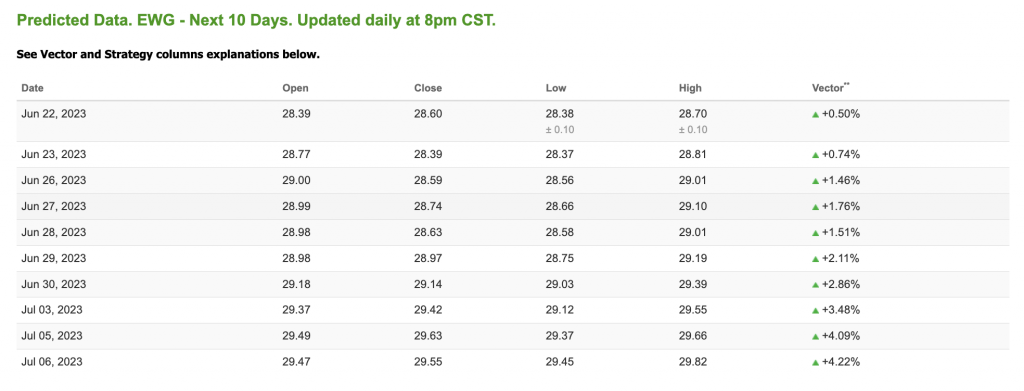

The ticker symbol $EWG represents the iShares MSCI Germany ETF. This exchange-traded fund aims to track the performance of the MSCI Germany Index, which consists of large and mid-cap German companies. By investing in $EWG, investors gain exposure to the German equity market, including industries such as automotive, manufacturing, technology, and finance. Shorting $EWG means taking a bearish position on the German market, anticipating a decline in the value of the ETF due to various factors like economic conditions, geopolitical events, or negative sentiment towards German equities. See 10-day EWG Predicted Data:

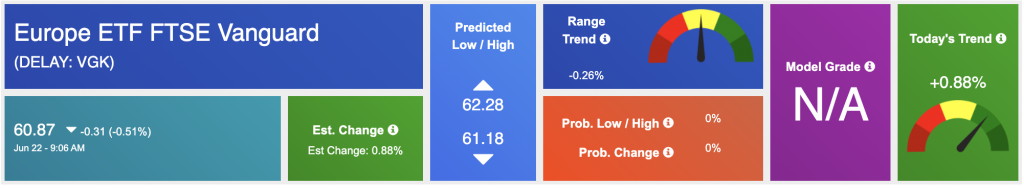

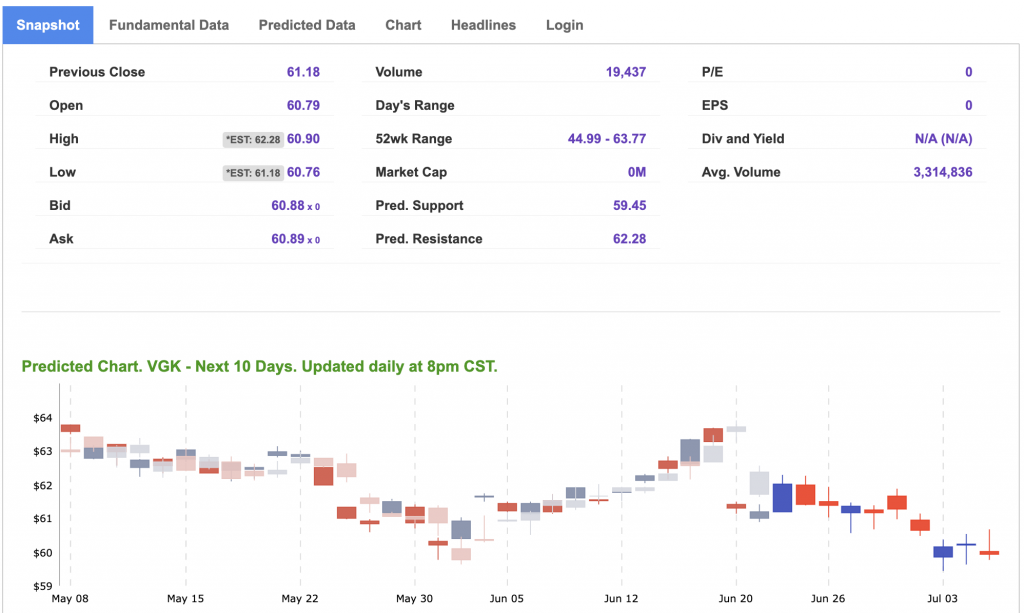

$VGK represents the Vanguard FTSE Europe ETF, which seeks to replicate the performance of the FTSE Developed Europe All Cap Index. This ETF provides investors with broad exposure to European companies across various sectors and countries, including the United Kingdom, Germany, France, Switzerland, and others. By investing in $VGK, individuals can participate in the European equity market, with holdings spanning industries such as financials, healthcare, consumer goods, and more. Shorting $VGK involves speculating on a potential downturn in the European market, driven by factors such as economic indicators, political instability, or sector-specific challenges.

Shorting the European market involves taking a bearish stance on the overall performance of European stocks. Traders who believe that European markets will experience a decline in value can engage in short-selling strategies. Short-selling is a technique where investors borrow shares they don’t own, sell them at the current market price, and then repurchase them at a lower price to return to the lender, pocketing the difference as profit. Shorting the European market can be influenced by factors such as economic trends, political developments, corporate earnings, or market sentiment. It is important to carefully analyze and consider various factors before engaging in short-selling strategies.

In light of the prevailing market conditions, shorting European markets has emerged as an intriguing strategy capturing the attention of investors. The combination of factors including sluggish economic growth, political tensions within the European Union, and the ongoing Ukraine-Russia conflict has created a cautious sentiment among market participants. Furthermore, the concerns surrounding rising inflation levels and the potential for tighter monetary policies serve to reinforce the rationale for shorting European markets.

Our AI-driven forecast data has identified several compelling signals that support the idea of shorting European symbols. Notably, both VGK and EWG exhibit negative vector scores, indicating an immediate downward trend for these symbols.

Throughout this year marked by volatility, we have witnessed targeted retracements across various asset classes and geographical regions, which serve as indications of a broader undercurrent of pessimism and selling pressure. While the U.S. markets have achieved a degree of stability following the resolution of the debt ceiling issue, Europe faces greater challenges due to ongoing geopolitical uncertainties that ripple through global markets. The recent decisions made by the European central bank and the persisting Ukraine-Russia situation further contribute to the prevailing uncertainties. Moreover, the implications of the current circumstances in China have surpassed initial expectations, introducing an additional layer of concern to the equation.

Given these circumstances, I will be actively seeking shorting opportunities in the European markets, leveraging the insights gained from our analysis.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

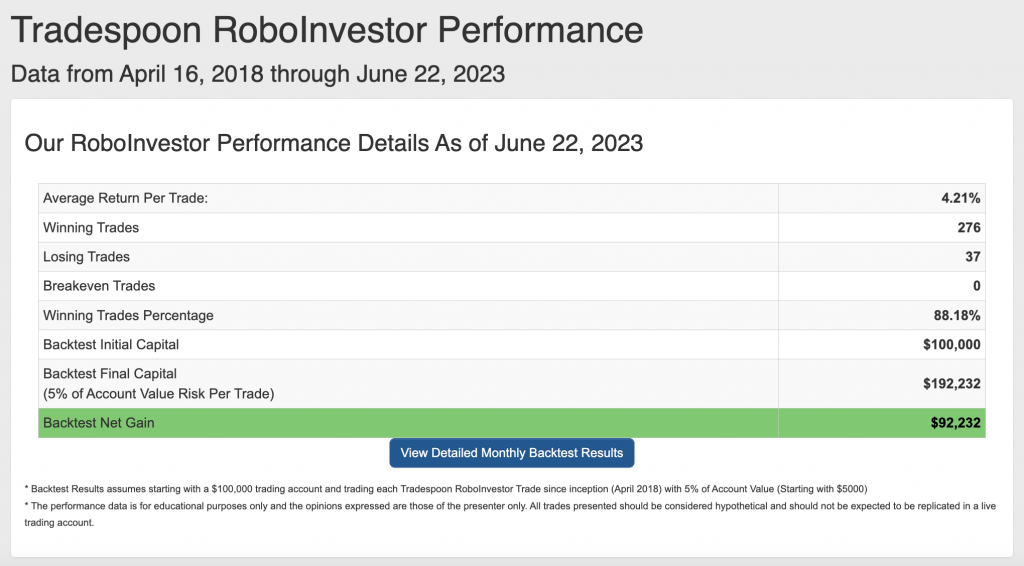

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.18% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!