RoboStreet – December 15, 2022

Fed’s Hawkish Tone Pressures U.S. Markets

On Thursday, stocks tumbled following the Federal Reserve’s latest monetary policy decision. Wednesday’s Federal Open Market Committee decision caused investors to be hesitant, as the central bank provided new suggestions indicating interest rates could increase faster and cause more severe financial hardship. For the past two days, markets experienced a downturn due to an array of issues including hawkish statements from the Fed, higher-than-expected inflation rates, reinvigorated recession fears, underwhelming retail numbers, and low unemployment.

Wednesday’s Fed move increased its benchmark federal-funds rate by a half-point – an unsurprising move for market watchers. This, however, was not the reason shares sold off. Shocking investors and pressuring the market was the central bank officials’ tone which indicated that they are aiming to raise rates above 5% in 2023 and keep them there for some time.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

After four steep hikes of three-quarters percentage points back to back, the central bank’s most recent measure is comparatively more conservative. This move was made in an effort to curb inflation which had been skyrocketing during the course of this year. According to the “dot plot” projections of Federal Reserve officials, interest rates may climb quickly in the near future. Predictions suggest that by 2023, the federal-funds rate will surpass 5% and stay at this heightened level for an extended stretch of time.

The Federal Reserve was mindful that rising rates could potentially reduce both economic demand and inflation. Moreover, they stressed their aim of averting a catastrophic recession as opposed to merely a mild one. However, the dot plots suggest that if inflation persists above 2%, then it is probable that the Federal Reserve will be unable to reach its intended targets.

Not only is the Federal Reserve increasing rates, but other central banks around the world are also taking similar action. On Thursday, the Bank of England and European Central Bank followed suit with the Federal Reserve by hiking short-term rates up by a half percentage point. Additionally, they signaled further rate increases in their near future plans.

Back in the U.S., retail sales plummeted by 0.6% in November, which is worse than expected; however, markets are quite content with this decline because it indicates that inflation could possibly drop and prompt a shift from the Fed’s approach. Likewise, ahead of the FOMC announcement on Wednesday, data released Tuesday showed prices had risen 7.7% year-over-year in November – a sharp deceleration from their 9% peak hit during the summer months.

Also pressuring U.S. markets: the lower-than-expected jobless claims figure of 211,000 – contrary to the forecasted 230,000. This, in turn, means if the signs are positive for labor market recovery and a gradual decrease in inflation, then it is not likely that the Fed will shift its stance quickly.

Despite the turbulence of the market, there was a ray of hope. Bond yields showed no signs of rising as the U.S two-year Treasury yield closed at 2.245% on Thursday – only slightly higher than its pre-Fed Chairman Jerome Powell’s speech level and unchanged from Wednesday’s close rate but still lower than its multi-year peak at just over 4.7%.

This week’s financial statements from $ORCL, $ADBE, and $COUP as well as the Consumer Price Index (CPI) data and Federal Reserve decision are playing a prominent role in deciding where the market will head next. With this in mind, there is one move I will be looking to make in the coming days as long as our market forecast holds up. Let’s break down the current market conditions.

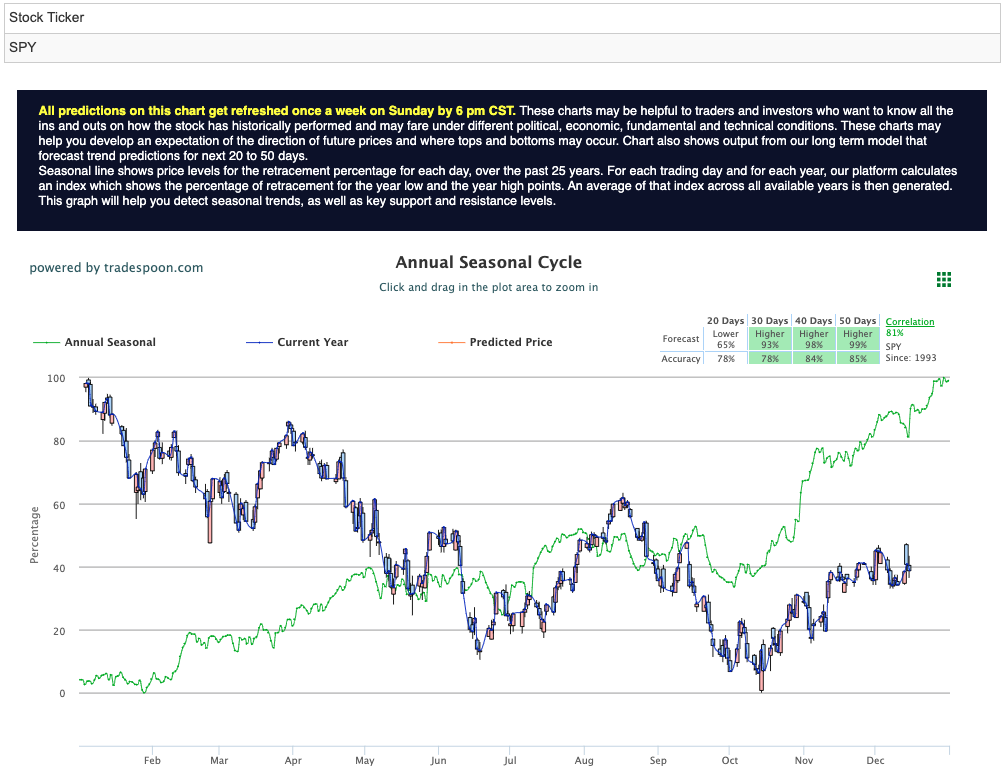

As we keep our eye on the $SPY, it’s clear that overhead resistance exists at both $400 and then $410. Supportive levels for this index can be found at a respective mark of $390 as well as an additional one situated at its ground level of $385.

With the market trending at this present range, we anticipate that a market top will form within the next two to four weeks. Those trading in the short term has already noticed how well-defined these boundaries are. At this juncture, it is critical that our subscribers maintain a market-neutral stance and not be driven by impulses to ride the waves of volatility either up or down.

Looking at these levels, it appears there will be room for additional dips in the coming weeks. While I do see the holiday rally supporting certain sectors if a market-wide selloff continues there is one symbol I will be keen to buy.

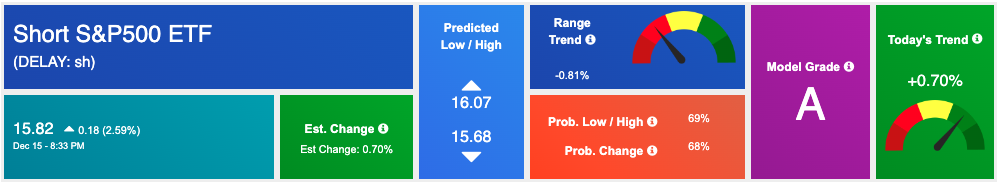

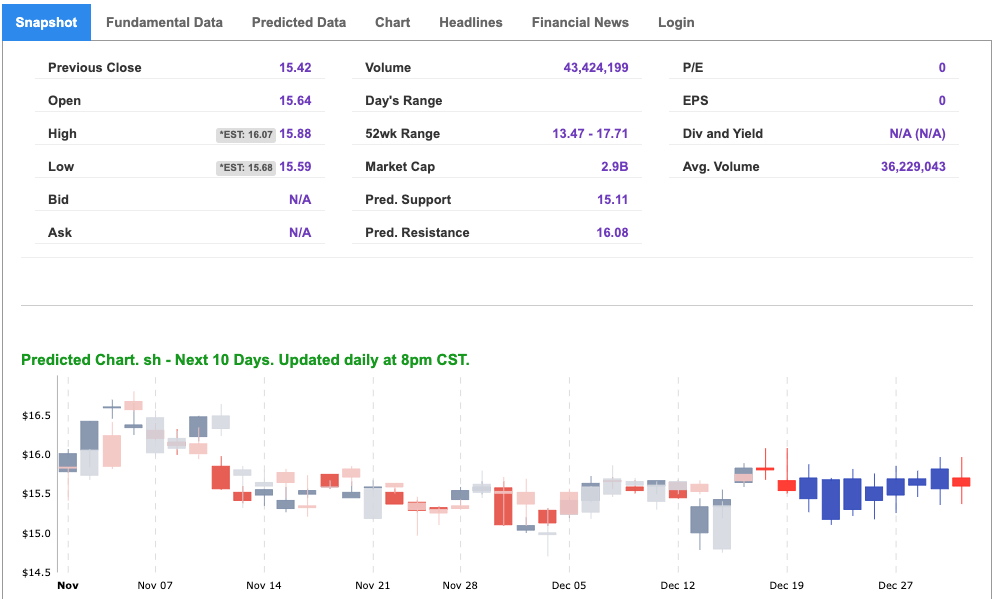

Short S&P 500 ETF (SH) is a short ETF that I have had great success trading in the past and it’s one of my all-time favorites. SH is one of my go-to’s for shorting the market and with the latest weakness in the tech sector, I will be looking to engage with SH again this winter. The symbol is trading just above $15 and right in the middle of its 52-week range of $13-$17. Having recently broken above our forecasted resistance, SH offers a unique opportunity if the market continues as projected above.

Similarly, the symbol sports a model grade of “A” indicating it is in the top 10% of accuracy for the Tradespoon data universe.

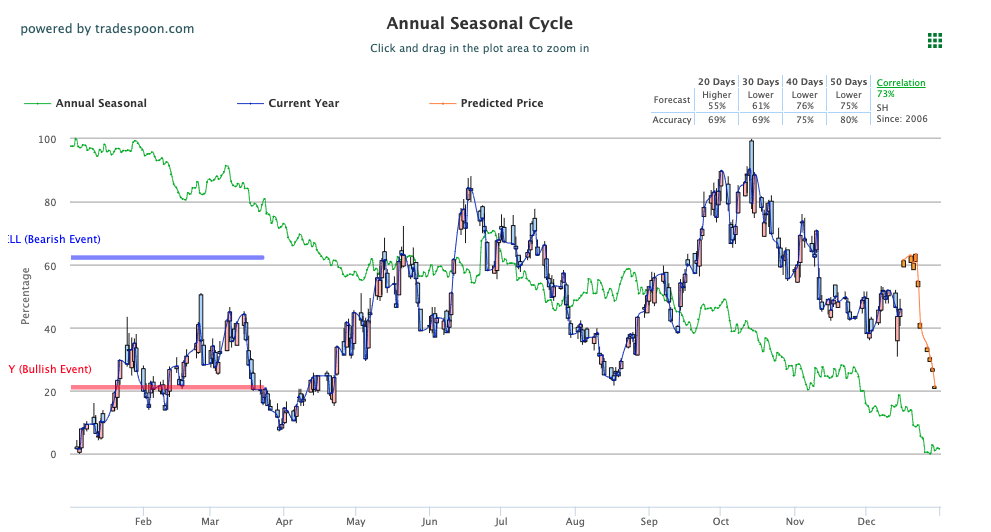

After we compiled SH data into the Seasonal Chart, our model for predicting long-term trends indicates several advantages. At present, there is a sizable divergence between the symbol’s current rate and its usual seasonal price over the course of any given year — implying that prices may rise in upcoming weeks. Adding to the impressive signal is that of the initial time range flashing the trading “higher” signal for the 20-day range. See SH Seasonal Chart below:

Historically, the market has rallied at the end of each year, so I’m expecting this trend to persist. However, there is also potential for tech stocks to dip as soon as next week. The bear market might come back before next year, putting SH in a great spot to purchase before any future dips occur. Through my recent data analysis of multiple market trends, I am confident that SH will continue to experience success in the future – and my A.I. arsenal agrees.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

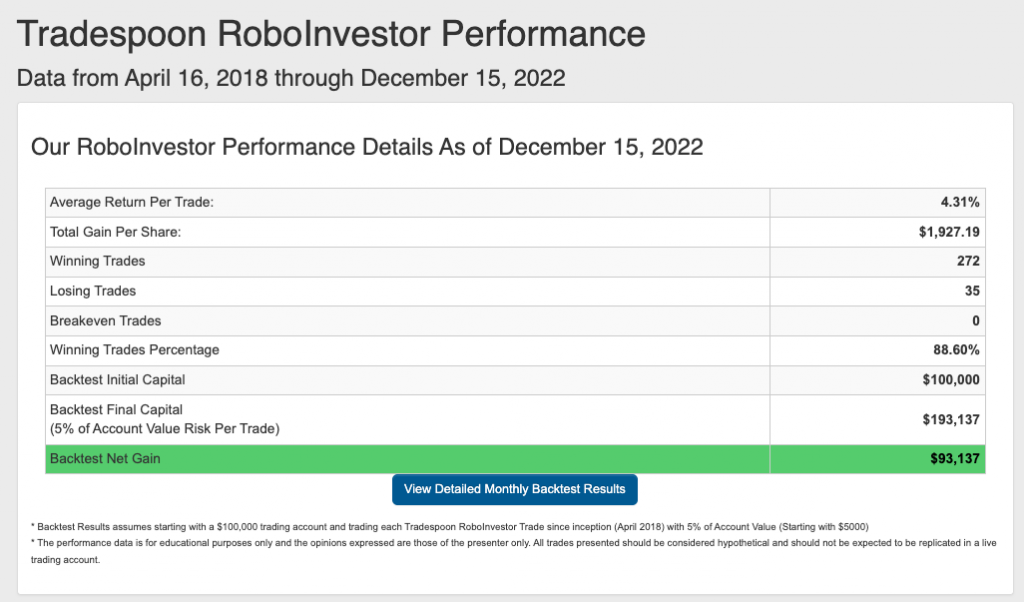

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.60% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!