RoboStreet – March 24, 2022

Bullish Pivot Under Way For Big Cap Tech

Stocks have rallied seven of the past eight trading sessions on the notion that the Fed will be more proactive in fighting inflation and some fresh reports that behind-the-scenes negotiations are seeing some progress. This all comes as NATO is set to increase sanctions and send scores of weapons systems and over a billion dollars in humanitarian aid. But to date, Russia is showing no signs of reducing or ceasing military pressure on Ukraine

As the war, persistent inflation, higher interest rates and surging oil prices continue to define the risks that investors have to contend with, stocks are responding favorably to the growing sentiment that these same risks noted are peaking. It is thought that these market pressures will begin to ebb in the months ahead as the economy cools from slower consumer spending and tighter Fed policy.

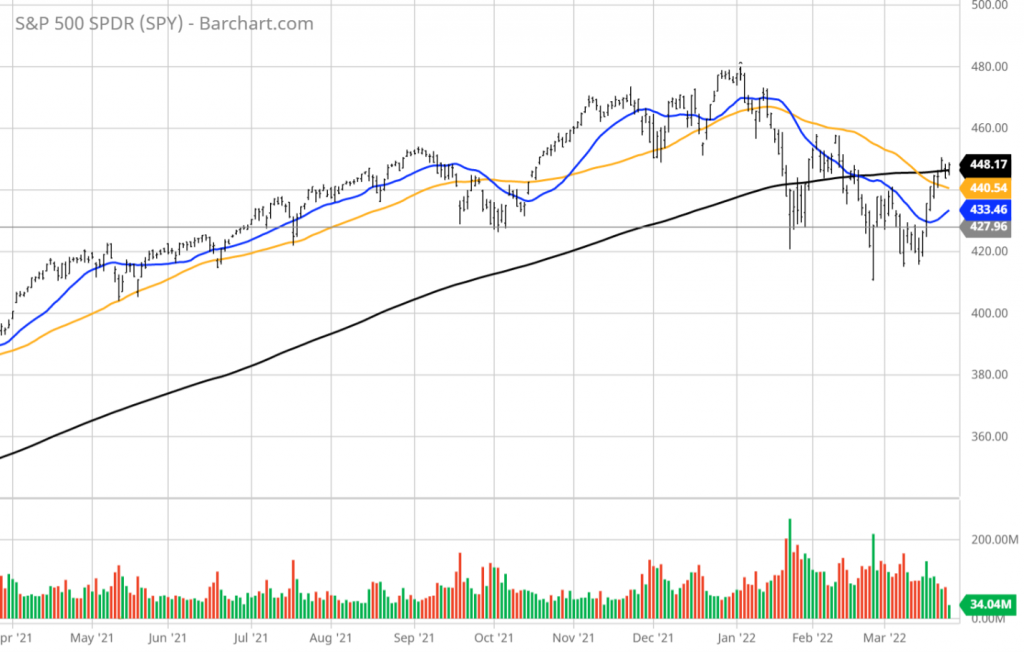

One can only hope, but the tale of the tape is beginning to shift from selling into rallies back to buying on pullbacks. What is most encouraging is that the mega-cap tech stocks are getting their mojo back, which is a major positive for the indexes. The S&P has managed to reclaim its 200 DMA, where if it can digest recent gains at this level, will open the way higher for the broad market heading into first quarter earnings season.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

CURRENT TRADING LANDSCAPE

As of Wednesday, the $SPY closed higher 1.4%, at $443, right at the 50 and 200 DMA. The value/reflationary ($VTV) closed lower 1.5%, at $146, above the 50 DMA. The technology sector ($QQQ) closed lower 1.5%, at $351, between the 50 DMA and the 200 DMA.

The $DXY closed higher, near the $98, at the June 2020 high. The $TLT closed higher 2.1% and near the 2020 lows. The ten-year yield closed lower at 2.3%. The $VIX closed lower near the 23 level.

The $SPY short-term support level is at $440 (key long-term support) followed by $430. The SPY overhead resistance is at $460 and then $470.

Assuming the geopolitical risks in Ukraine have reach status quo, it is reasonable to assume that the $SPY February low is set and the pattern of higher highs and higher lows will emerge in the next two to six weeks.

I would be a buyer of the low beta stocks into the pullbacks and have market BULLISH portfolio at this time.

I do not expect the $SPY to post new all-time highs in the first half of this year. There is a high probability that the $SPY main long -term support at $415 is now set but might be retested in the next few months.

If you are trading options consider selling premium with May and June expiration dates.

Based on our models, the market (SPY) will trade in the range between $415 and $470 for the next 2-4 weeks.

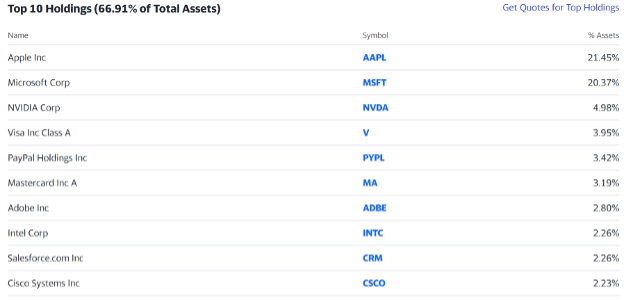

The Technology Select Sector SPDR ETF (XLK) is an excellent proxy for the tech sector and with a basket of leading stocks that capture the initial attention of investors when they want to get back into the market. The top ten stocks make up about 67% of total assets.

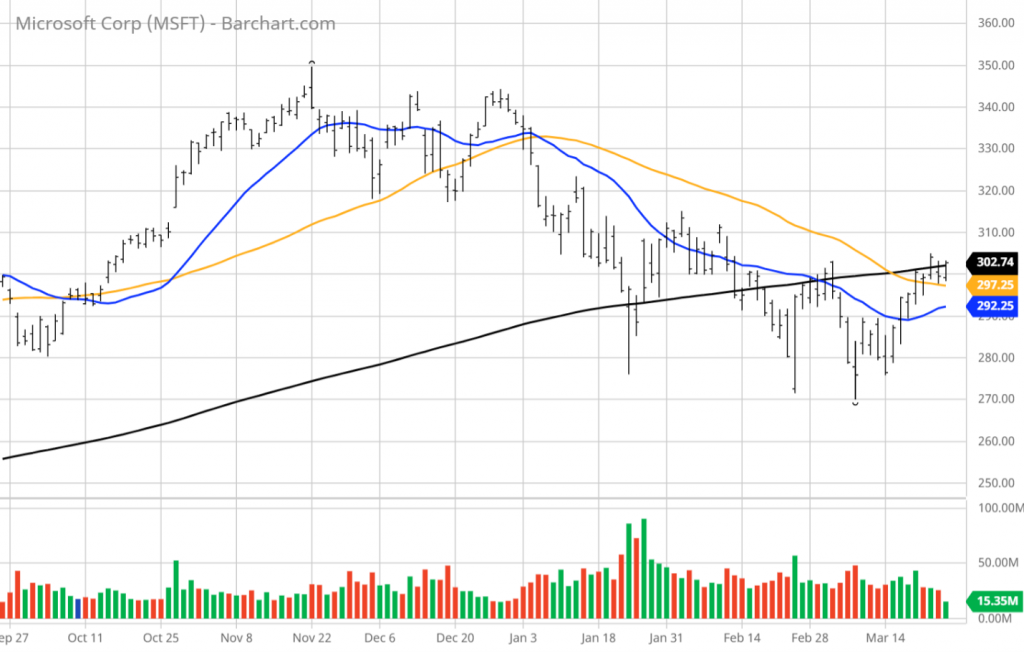

Of the stocks in the XLK that are a key barometer to the health of the tech sector, I would argue that Microsoft Corp. (MSFT) is one of the three or four companies where the bulls place their long-term confidence in. Their business model is very diversified and positioned in many of the core growth areas that have strong fundamentals.

Microsoft offers the Windows 10 operating system, Azure cloud services, Outlook email, Office 365 security, Microsoft Teams, Skype, OneDrive, Surface computers, Xbox gaming platforms, LinkedIn job market services and is in the process of acquiring Activision gaming software. All the company’s divisions are experiencing strong growth.

2022 revenues are forecast to grow by 18% to $199 billion from $168 billion in 2021 and for earnings to come in around $9.34 per share compared to $8.05 for 2021 according to the consensus of 26 analysts compiled by www.yahoofinance.com.

Our RoboInvestor investment advisory service is built around a proprietary AI-driven platform that guides our stock and ETF selection. One of our AI tools is called the Seasonal Chart where the algorithms determine levels of bullish or bearish probability of direction. In the case of MSFT, we get a “Higher” probability reading for the next 20-day period and also for the 40 and 50-day periods.

Within RoboInvestor, the portfolio will consist of between 50-25 positions that are made up of blue-chip stocks and ETFs that represent the major indexes, market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility and shorting opportunities via inverse ETFs.

Every other week, we email out the RoboInvestor newsletter over the weekend with two new trades to act on when the opening bell rings on Monday. Our AI system provides our entry points as well as our exit points, that we email out to subscribers when our indicators instruct us to do so.

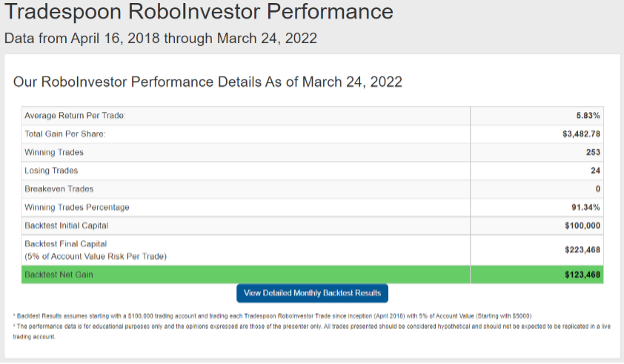

Our AI platform has had a hot hand for the past four years, amassing a Winning Trades Percentage of 91.34%. To my knowledge, this track record over this time period is unmatched in the retail advisory business and a performance record that we take great pride in, while continuing to refine it.

I personally place my own investment capital in every trade I recommend, so I’m on the same journey to building wealth as our RoboInevstor members. No paper tigers here, just hard work and a very intelligent AI-driven platform that is always thinking, always crunching data and always learning 24/7.

Take me up on my offer to come alongside you and your portfolio, provide ongoing training, coaching and high-probability trades for 2022 and years to come. Winning better than 9 out of every 10 times you put your money to work in the market is how we pad our long-term growth. Being consistent is the hallmark of great investing and RoboInvestor continues to prove itself even in the most challenging of markets.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!