RoboStreet – October 20, 2022

Yields Spike While Earnings Support Markets

Despite a positive start to the third-quarter earnings season, U.S. stocks ended Thursday lower as Treasury yields reached new multiyear highs. Markets saw an up-and-down week which also featured the latest Beige Book and the continuation of the earnings season. Corporate earnings are due to continue next week with several marquee names as well as GDP and PCE reports.

Although all three indices decreased today, they are on track to book weekly gains as of Thursday. The Dow increased 3.6%, while the S&P 500 raised 3.8%. And with a 4.8% gain, the Nasdaq is preparing to end this week better than it has in more than four weeks.

Key earnings that topped estimates and saw shares spike include Netflix, AT&T, and IBM. With most earnings thus far seeing positive reports major U.S. indices were able to stop the latest slide in the market after developing a bottom. Not all earnings have been great, with Tesla for example seeing shares fall after missing target estimates.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Along with the support the market saw from positive earnings, the latest Beige Book, released on Wednesday, offered some positive insight into the current state of the economy. The Beige Book for the latest quarter showed continuing inflationary pressures in all 12 financial districts. However, on a positive note, there was “modest” growth reported for the U.S. economy as a whole. Several sectors even showed impressive growth that ultimately helped relieve the extreme pressure the market has seen from troubling inflation data.

Still, the latest movement in the bond market has sparked concern, as well as volatility, in recent days. With U.S. Treasury yields spiking upwards, stocks took a tumble in premarket trade before stabilizing somewhat as investors reacted to stronger-than-expected quarterly earnings reports. The 10-year yield rose sharply to 4.228%, the highest it’s been since July 2008, resulting in another wave of stock market volatility.

With the latest levels of the market in mind, it is becoming clear that the latest bottom may have been developed after breaking below the mid-summer low. Earnings season appears to have reversed course as most reports have come better or in line. Likewise, the upcoming midterm election should provide clarity and remove lingering political uncertainty which also weighs on the market.

As inflation remains prominent, the latest earnings and Beige Book data show a growing and spending economy. Airline earnings, for example, have shown that people are still traveling despite growing ticket prices. We’ve seen similar positive support counter to the growing gas prices as oil and energy have become a prominent point of contention. With this in mind, I have identified a symbol and sector I will be looking to become involved in the coming weeks.

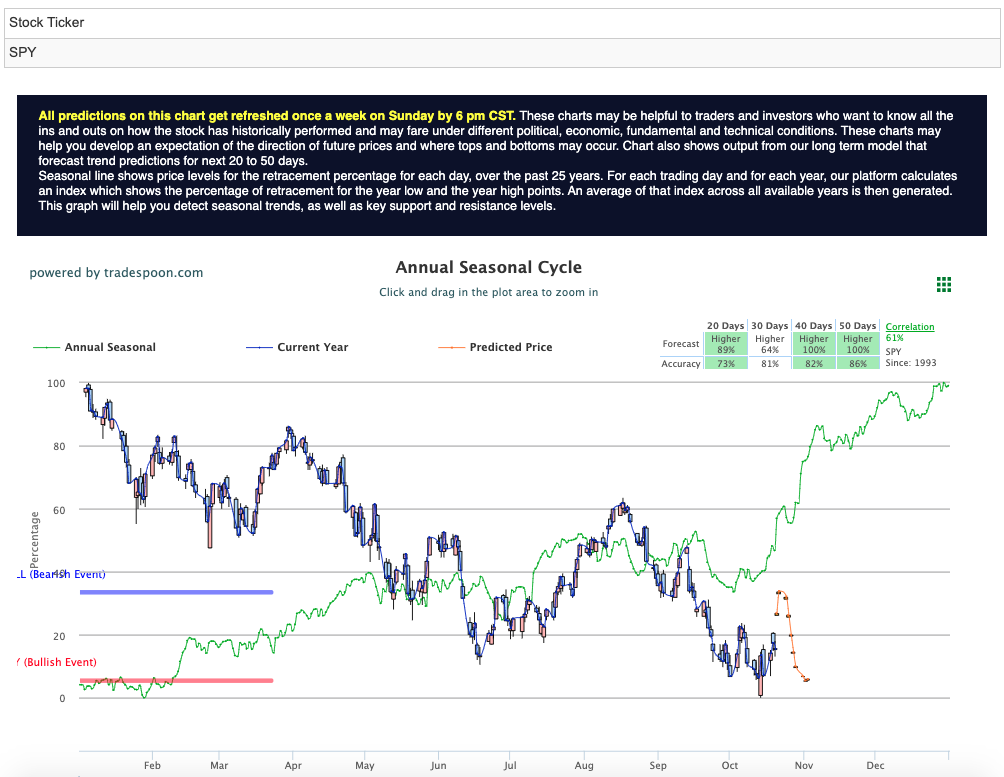

The current market direction appears to be up. The bottom, for now, has been developed with overhead resistance levels in the SPY presently at $380 and then $390. The $SPY support is at $367 and then $357.

As it stands, I believe the market will continue to stabilize over the next few weeks. The current market trend is oversold and could result in a rally within the next few sessions. In our latest Market Commentary reports we have advised buying into any further sell-offs, but not to try and get too far ahead of the market by chasing it downwards.

So far, earnings season appears to have followed the trend major banks such as Chase and Bank of America set, with their reports which topped estimates and helping shares trade higher. This resilience is a good sign and one that could continue moving markets higher. In order to capitalize on this trend, I have reviewed my A.I. toolset and identified a symbol perfect for any potential rallies that could come.

Netflix, Inc. (NFLX) offered strong earnings and has been one of the better surprises to come out of the latest earnings season. As I reviewed the latest trends in the markets, the technology showed great room for the upside and even furthermore- marquee names that have underperformed.

The latest earnings report supported Netflix’s move higher but still showed the symbol could perform in times of apparent weakness. Inflation has pressured most sectors in the market. As we build momentum from the latest earnings season, and onto the midterm elections, I believe multiple rallies could be staged – and Netflix should benefit from them.

Markets have reversed course after the Volatility Index hit a high of $36 and as Treasury Yields remain an issue with growing rates, it looks as though, for now, earnings can counter that market-wide pressure and offer symbols a path higher. Let’s double-check with my A.I. tools.

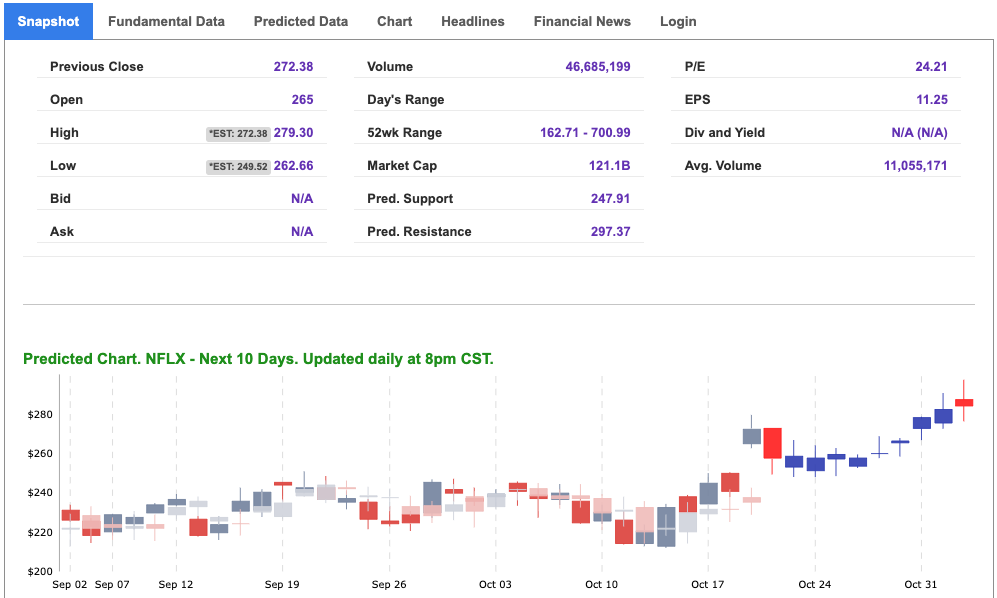

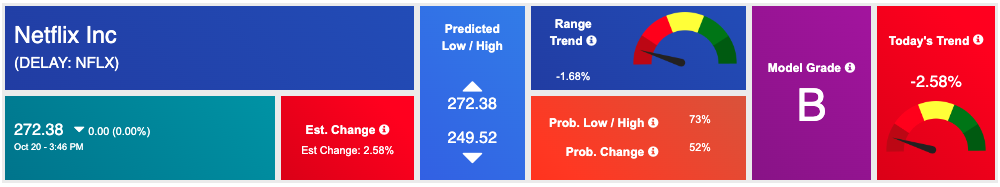

Netflix is showing a model grade of “B” which ranks at the top of the accuracy rating for the Tradespoon Stock Forecast data universe. The SFT model indicates that shares will likely trade higher, and after reaching the predicted high, could continue to rise. The forecast also shows a strong probability of movement between the forecasted low and high, as well as an increasing vector trend.

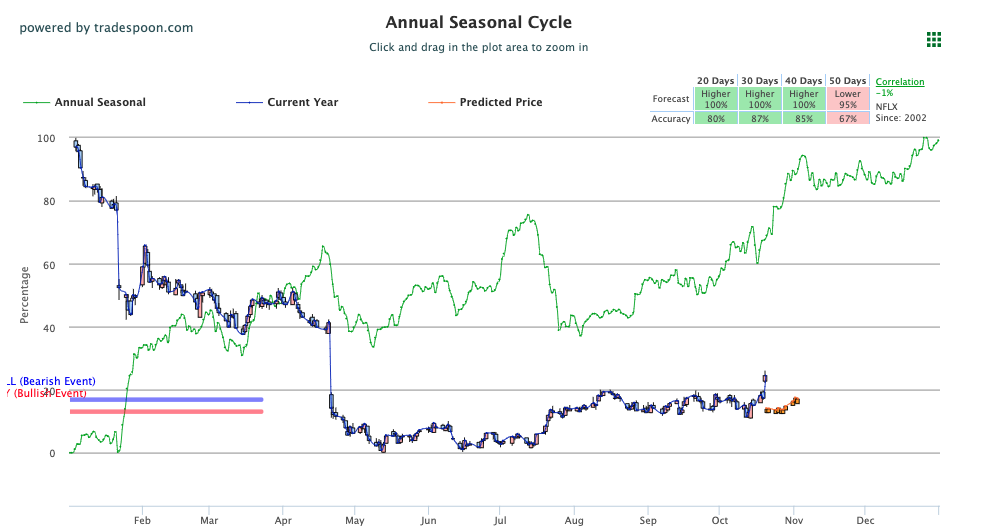

Reviewing the $NFLX Seasonal Chart, we see that there is a big gap between the annual season price, marked in green, and the current year price, marked in blue. The symbol is showing potential to go higher in the next 20, 30, and 40-day ranges with a decently high forecast percentage. This forecast is similar to the one we saw in the Stock Forecast Toolbox, which only adds to my confidence in the symbol. See $NFLX Seasonal Chart below:

As the dollar hit a multi-decade high, global conflicts continue to brew, and uncertainty regarding Fed action gets removed, it is clear we are due for a volatile year. Still, there is room to book profits during the volatility and that’s exactly what I’m planning on doing.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

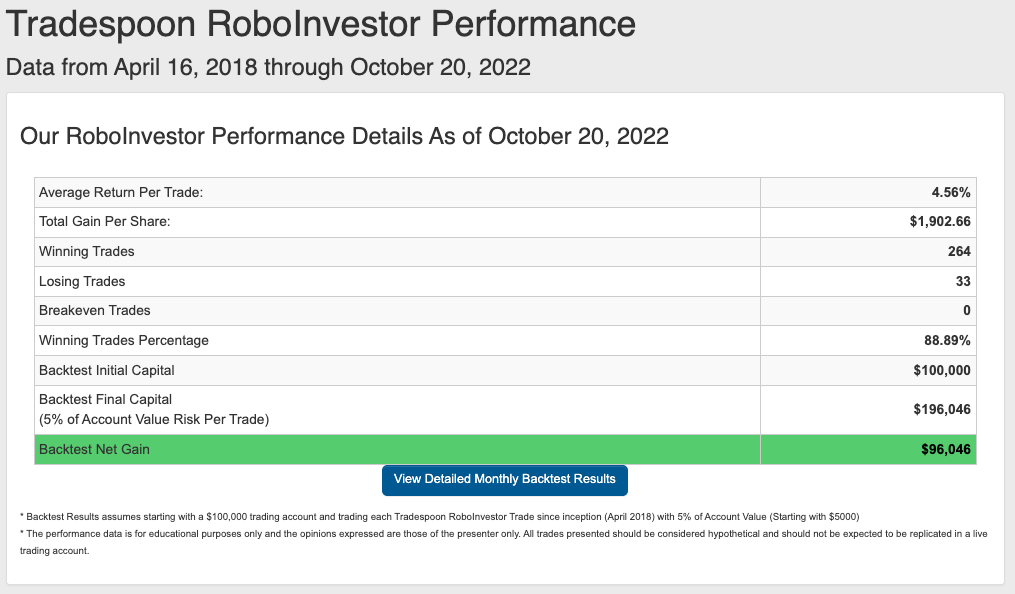

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.89% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we just started Q4! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!